1. New accounts and numbering

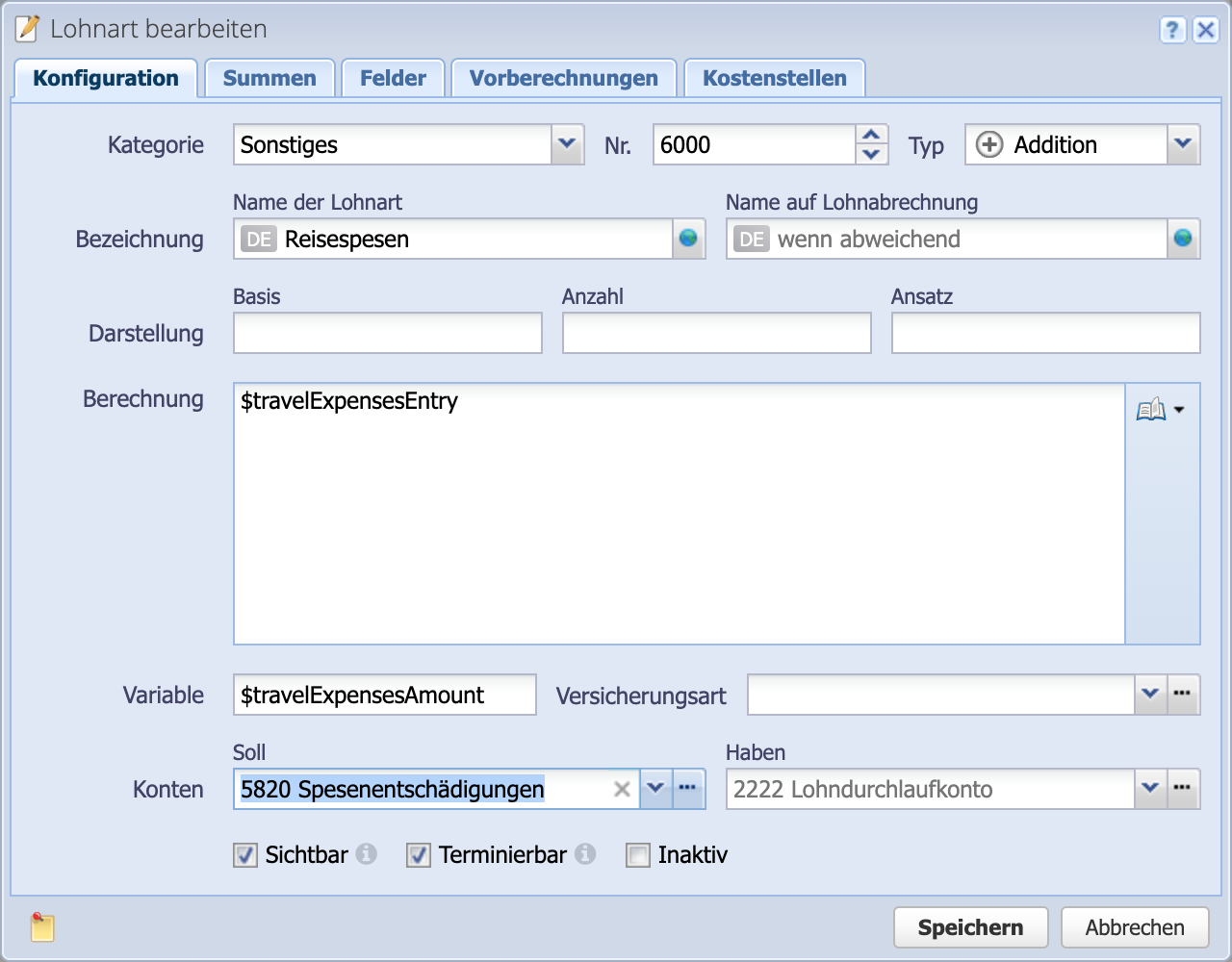

PRO Accounts: To make payroll accounting work, new accounts are added to existing organizations. These are created in the Personnel expenses category. If an account number already exists, the automatically created account is given the same number with an appended .1. In the screenshot, this is the case for account 5820.1 Travel expenses, for example.

There are various options for dealing with these duplicates. See next step.

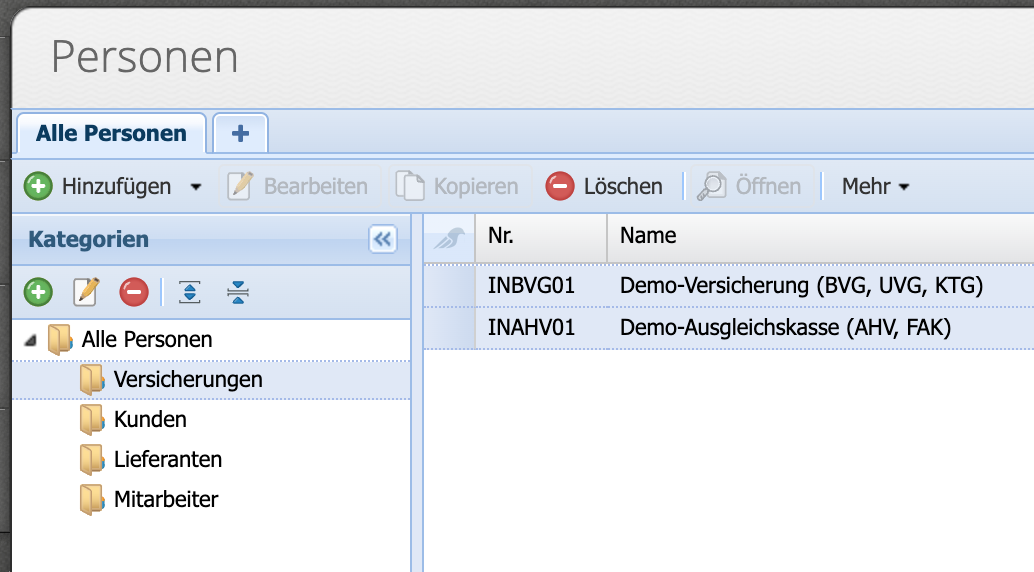

FREE accounts: if the newly created accounts are not required for a possible PRO upgrade or later use of payroll accounting, they can be deleted. If an upgrade to PRO is carried out, the accounts must be entered in the salary types. If you find this too difficult, simply set the accounts to inactive.