How the fiscal periods work

Fiscal periods in CashCtrl are like brackets enclosing a { specific section } of accounting.

Accounting in CashCtrl is like a continuous, chronologically sorted string.

Please enter a search term.

Error ~ No results could be loaded.

Fiscal and payroll periods in CashCtrl are clear and easy to follow. They can be created independently and individually and can also be managed for overlong or short years.

Content

Watch setup as a video (German)

Fiscal periods in CashCtrl are like brackets enclosing a { specific section } of accounting.

Accounting in CashCtrl is like a continuous, chronologically sorted string.

While the payroll period (only relevant for PRO) must correspond to the calendar year (at least in Switzerland), the fiscal period can differ from the calendar year, so you can enter a different start/end date.

Book entries can only be created if they fall within an existing fiscal period. The periods of an fiscal period can be very different.

Longer financial years are just as possible as shorter ones. The only condition for fiscal periods is that all periods are consecutive and there is no gap.

The fiscal periods dialog is opened by clicking on the calendar Manage or via Settings Fiscal periods.

An existing fiscal/payroll period can be edited via Edit. The name and periods can be changed here.

The duration of an existing fiscal period can be adjusted, provided that the change does not result in an overlap with another fiscal or payroll period.

A fiscal period can only be deleted if it does not contain any postings or if the period of the postings is covered by another fiscal period.

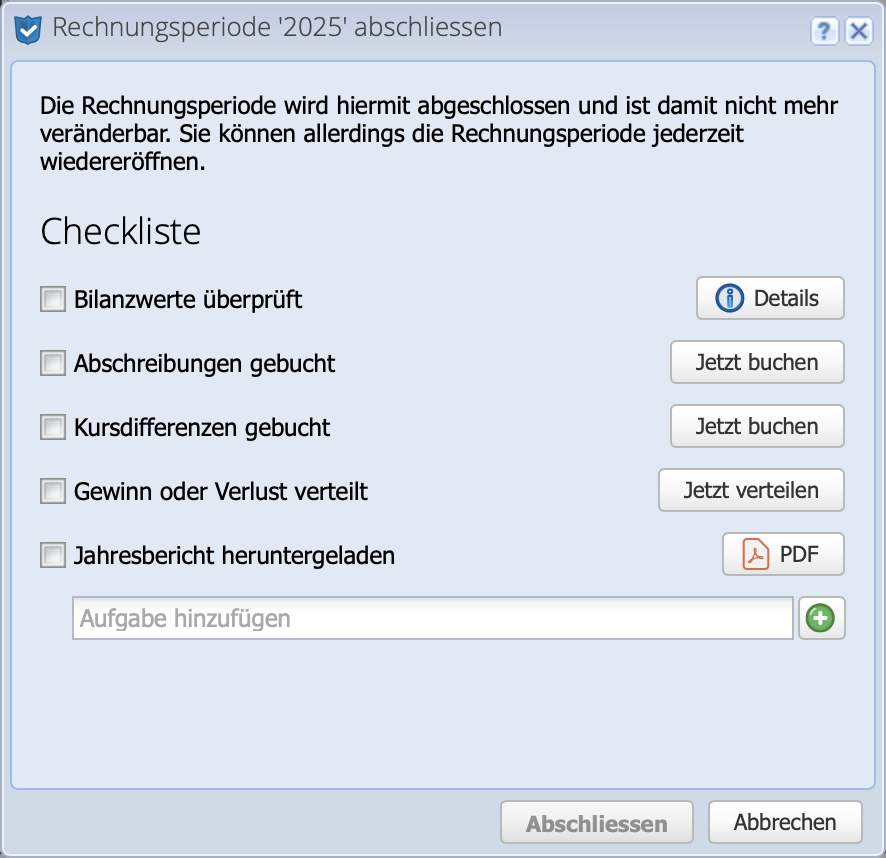

If a fiscal period is closed, all documents and bookings contained in it are fixed and can no longer be changed. However, a fiscal period can be reopened or unlocked at any time.

If adjustments are still necessary after the year-end closing, a closed accounting period can be reopened at any time. To do this, click on the calendar symbol and then in the drop-down menu Reopen Fiscal period Entire period. Confirm the query — done.

If months have also been closed, the month in which the booking is to be corrected must also be unlocked again.

After all adjustments have been made, the fiscal period can be protected from changes as usual at the top right via Close.

Important

The postings for the annual financial statements, such as profit/loss appropriation etc., are not deleted by a reopening. The year-end postings should therefore not be carried out again if a reopened accounting period is closed again. Unless the adjustments change the accounting with regard to profit / assets / foreign currencies, then the existing closing entries must be deleted and posted again in the year-end closing dialog.