Quick start possible?

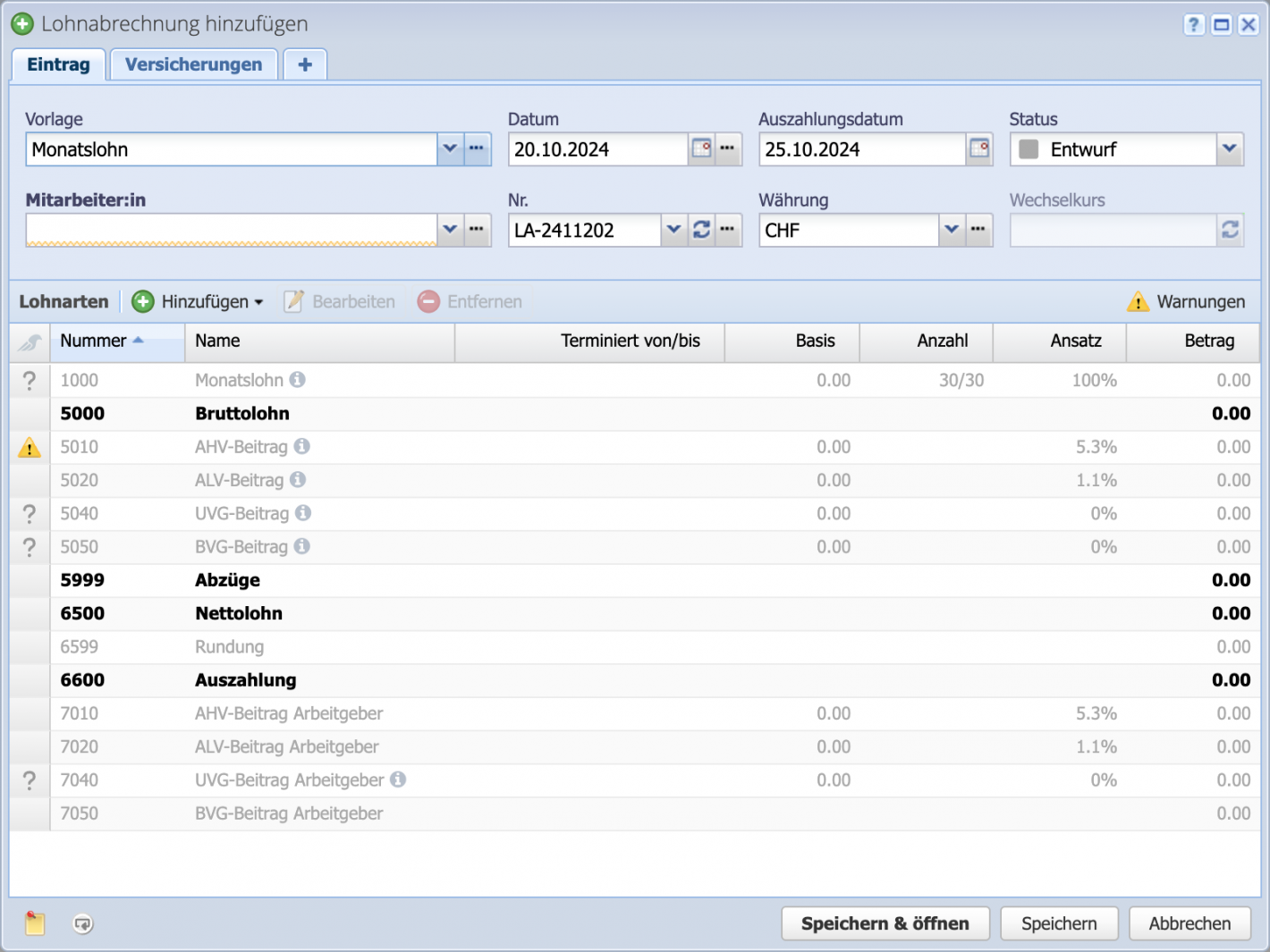

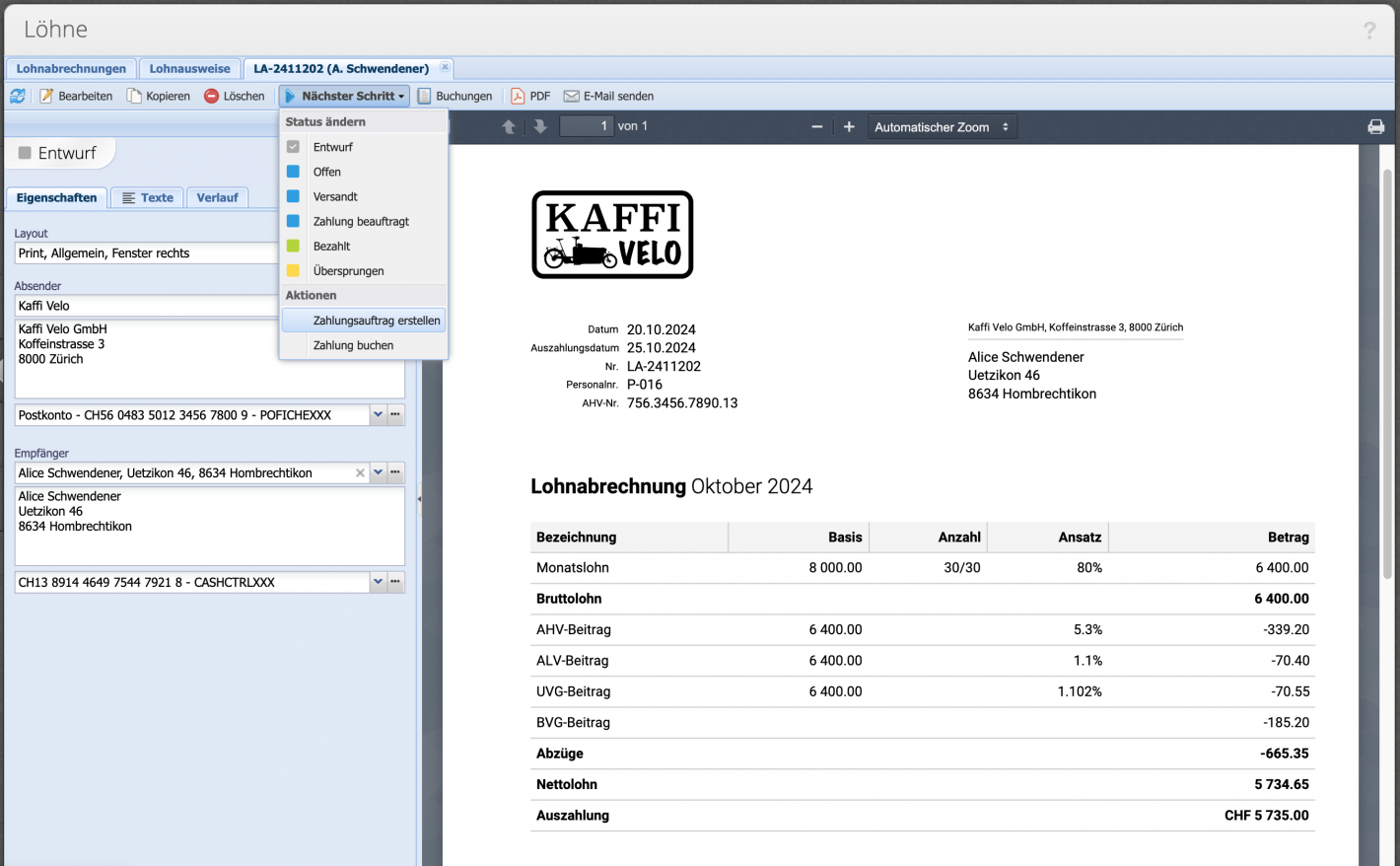

To create a payroll statement, the following steps must already be completed:

- Person / contact entered as employee?

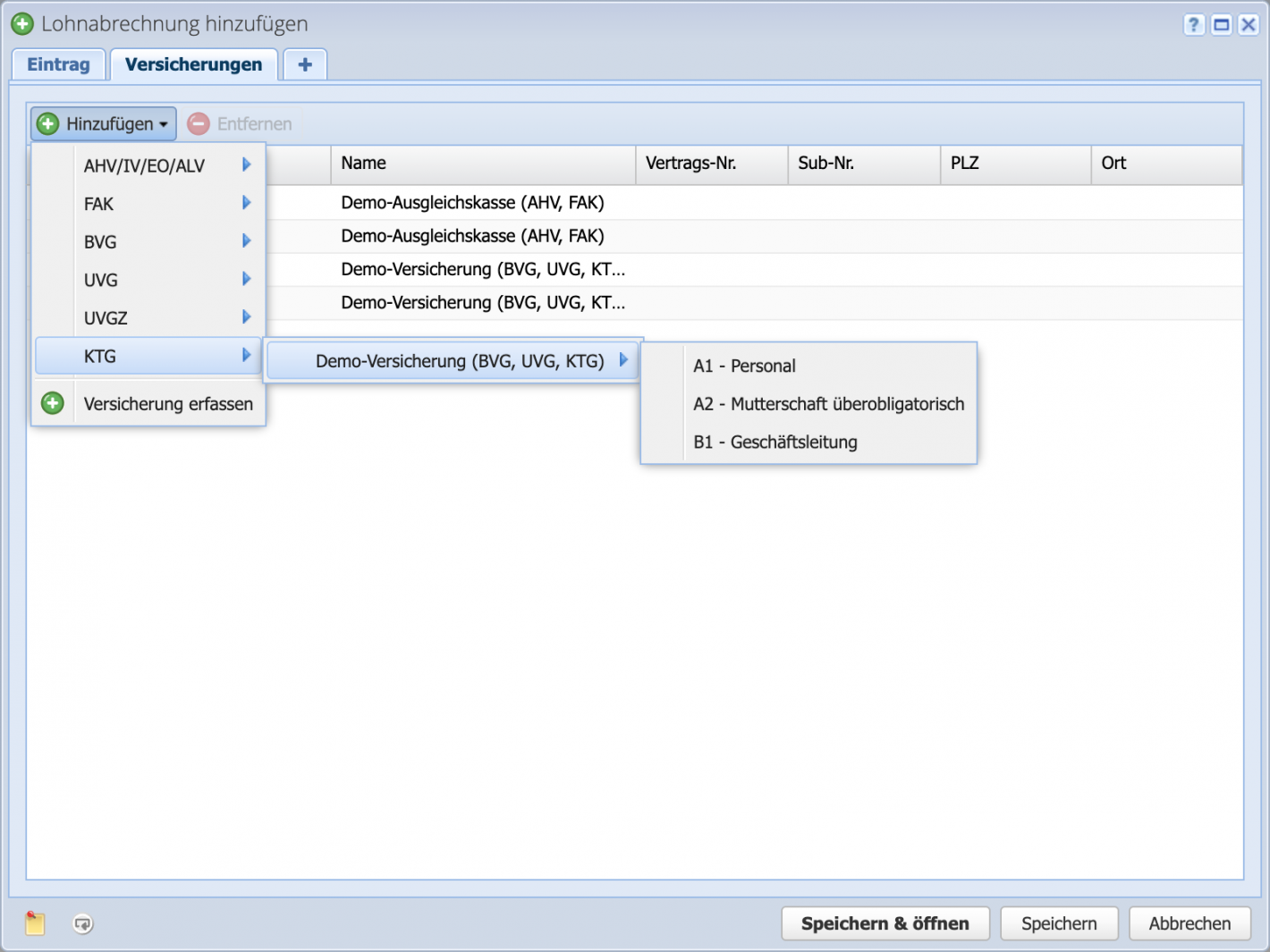

Enter employees Tutorial - Insurance recorded?

Record insurance Tutorial - Location completed (optional)?

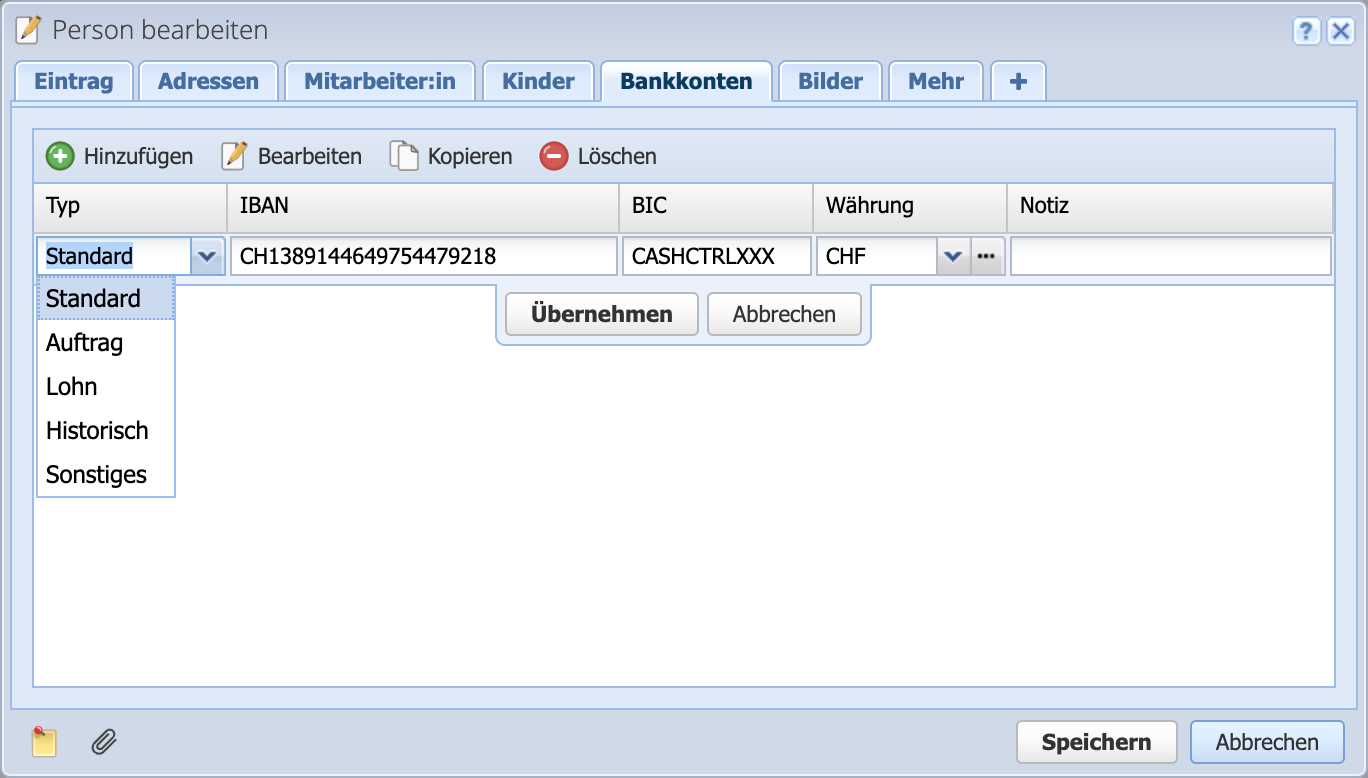

- Salary payment account entered (optional for payment via painfile)?

Otherwise, click here for the complete first steps tutorial including setup