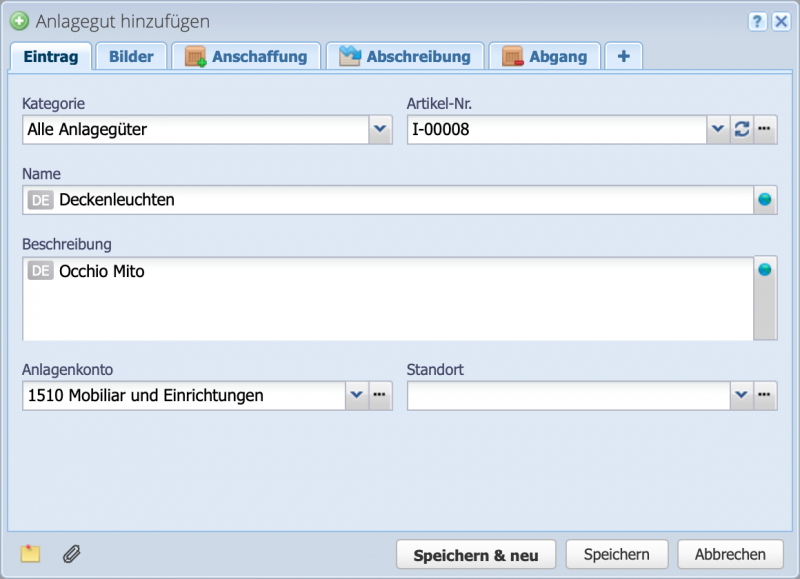

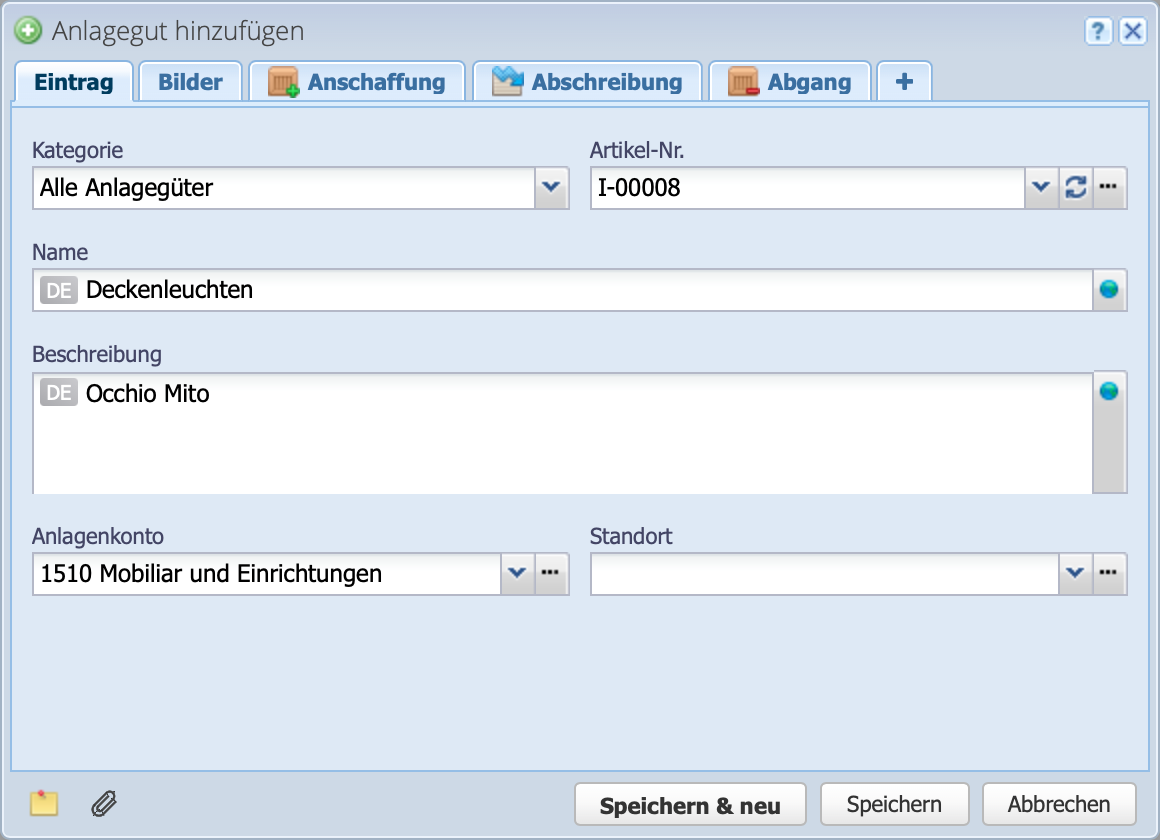

1. Add fixed asset

In the Inventory module, click on the second tab Fixed assets and open the dialog box via Add. Here you need to set a name and the asset account. Entering a description and the location are optional. By clicking on Save CashCtrl opens the second tab Images. Here optionally a picture of the asset can be stored.