1. Identify the time of origin —

a good start

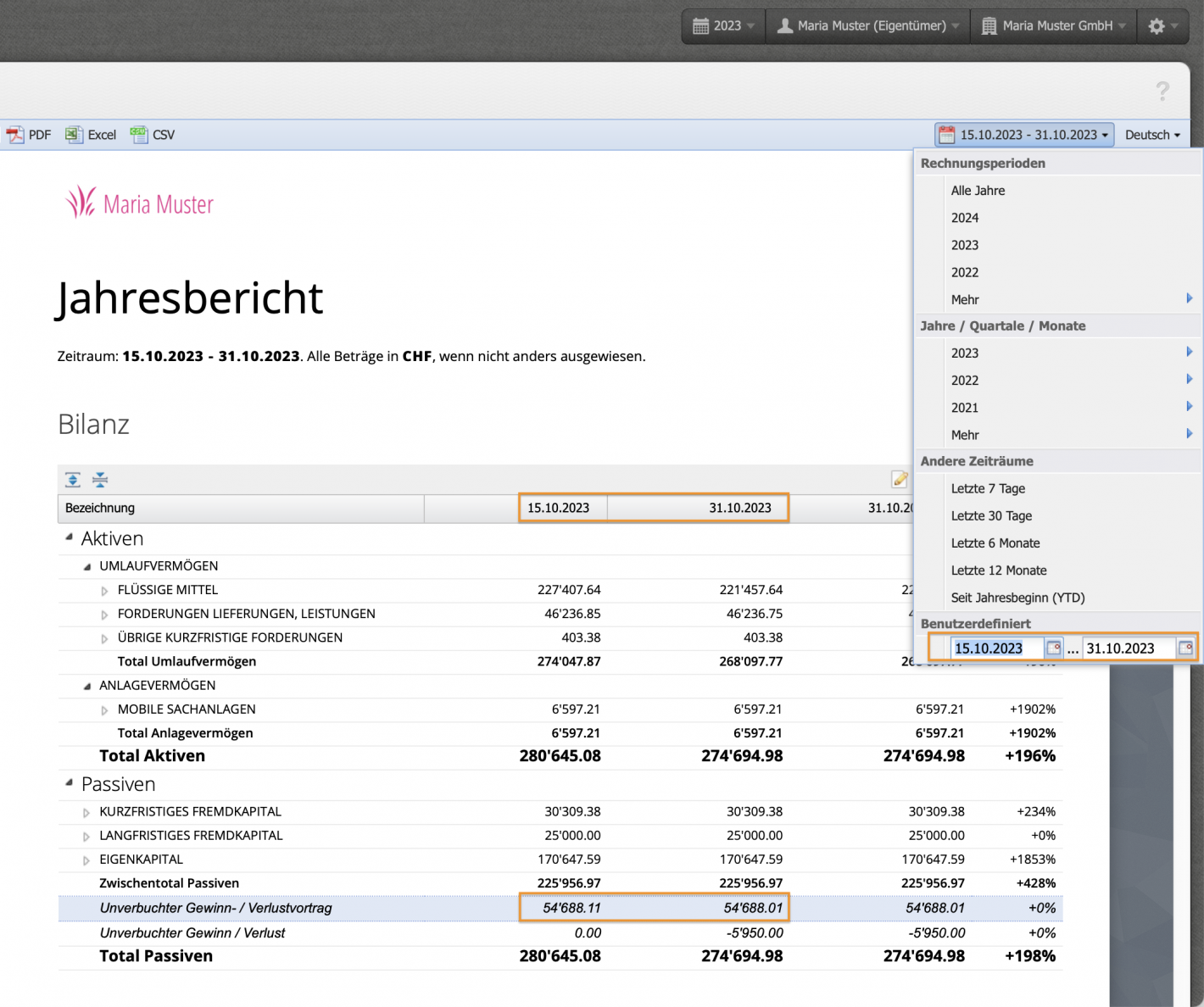

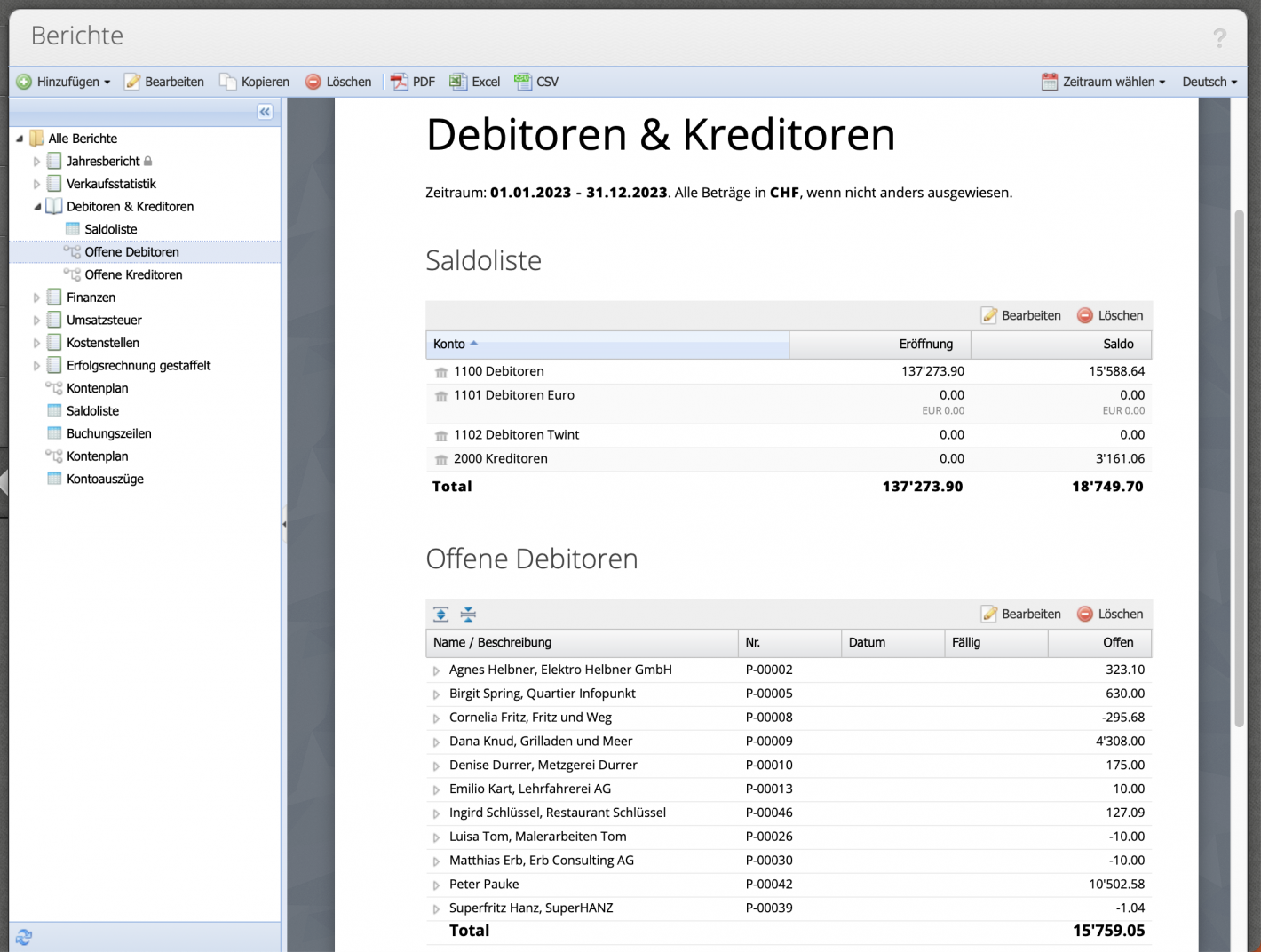

In the balance sheet report, display the opening balance sheet, final balance sheet I and final balance sheet II columns. The discrepancy becomes apparent when the number (e.g., of the profit carried forward) in the Opening column (e.g., 10/15/2023) differs from the number in the Final Balance Sheet column (e.g., 10/31/2023).

To narrow down the period, click on the Select period button at the top right, where you can choose from a selection of predefined periods (semesters, quarters, months) or filter user-defined by date.

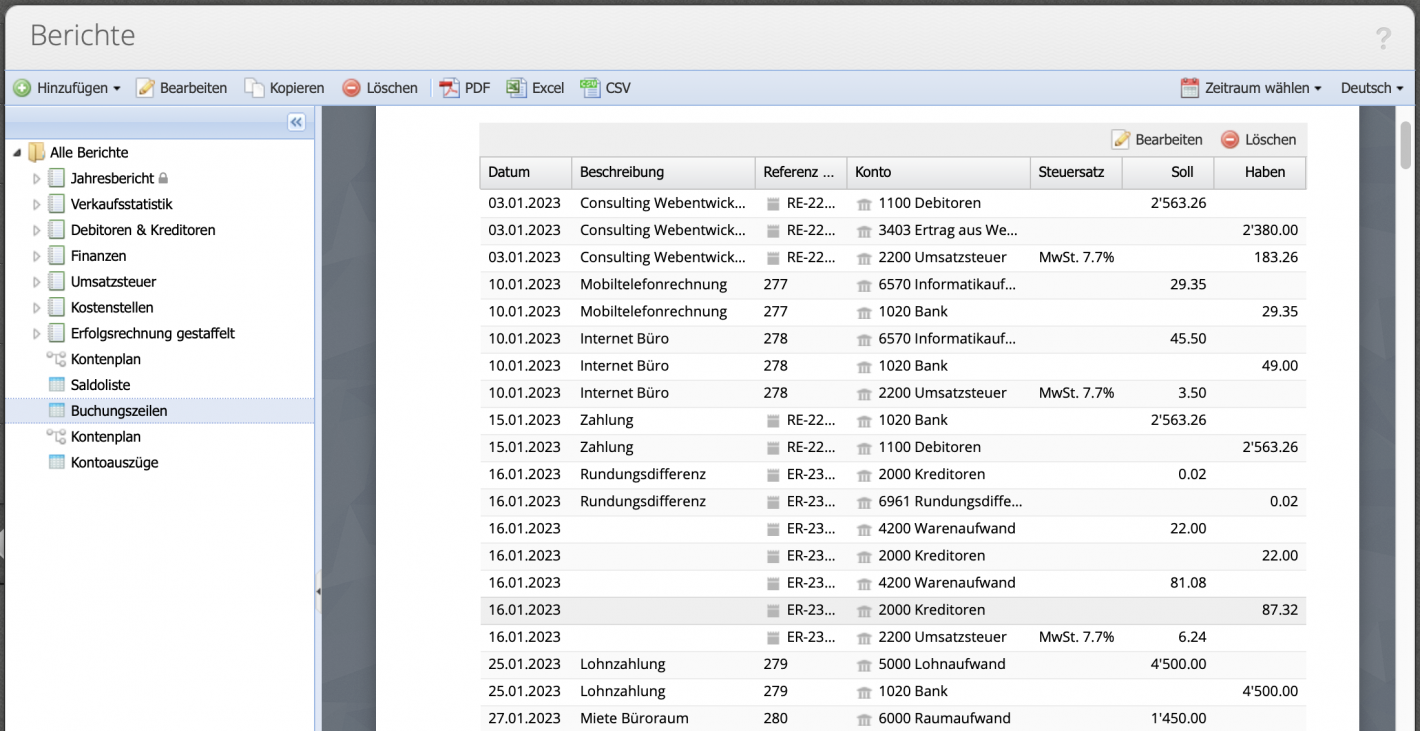

Filtering is done from large time periods to smaller and smaller ones down to one day. If, for example, it is evident that the discrepancy exists with filter on the second semester (S2), but not in the period S1, it is clear that it must have arisen in the second semester. To get closer to the time, we test whether the discrepancy appears in the 3rd or 4th quarter. If it appears in the 4th quarter but not in the 3rd, filtering is done month by month for October, November and December and finally user-defined week/day by day until the time is clear down to the day.