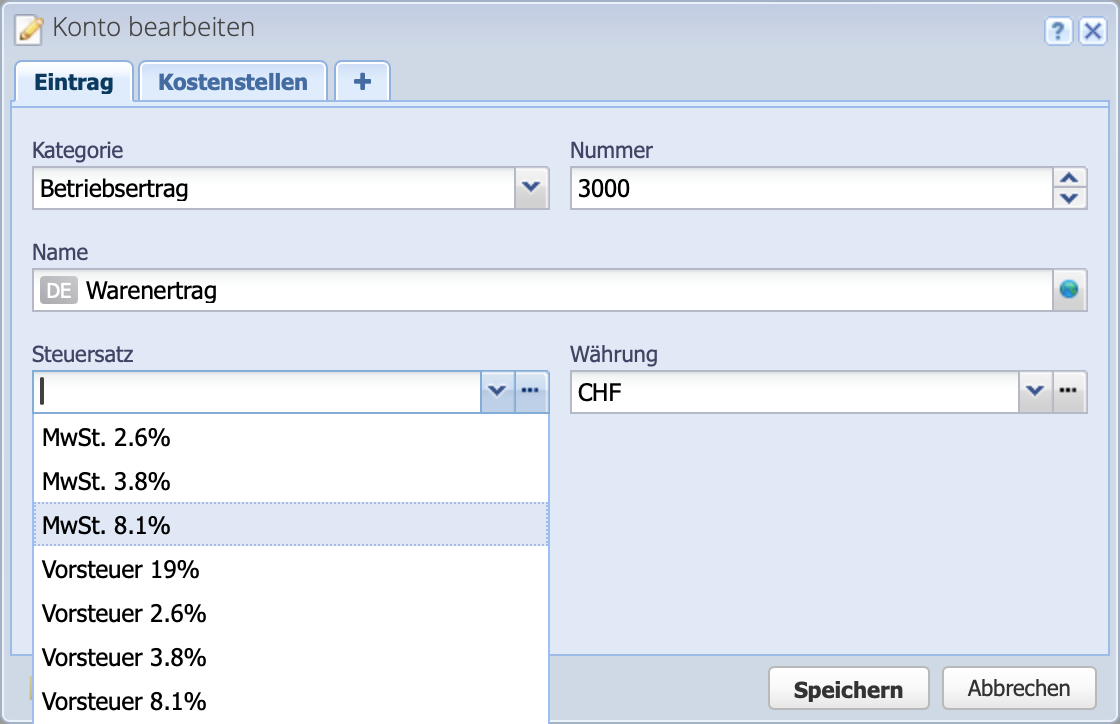

1. Enter tax rates

If the own company is liable to VAT, the tax rates must be set up before entries are made. Via Settings Tax rates the tax rate dialog is opened. By default, three VAT rates are available. You can add your own tax rate or modify an existing one.

An existing tax rate can only be modified or deleted if it is not referenced in any book entry. If a tax rate has already been used, it can be set as inactive so that it is no longer suggested in a book entry.

The net tax/flat tax rate field can be left empty unless a net tax/flat tax rate is to be used. Link to the tutorial