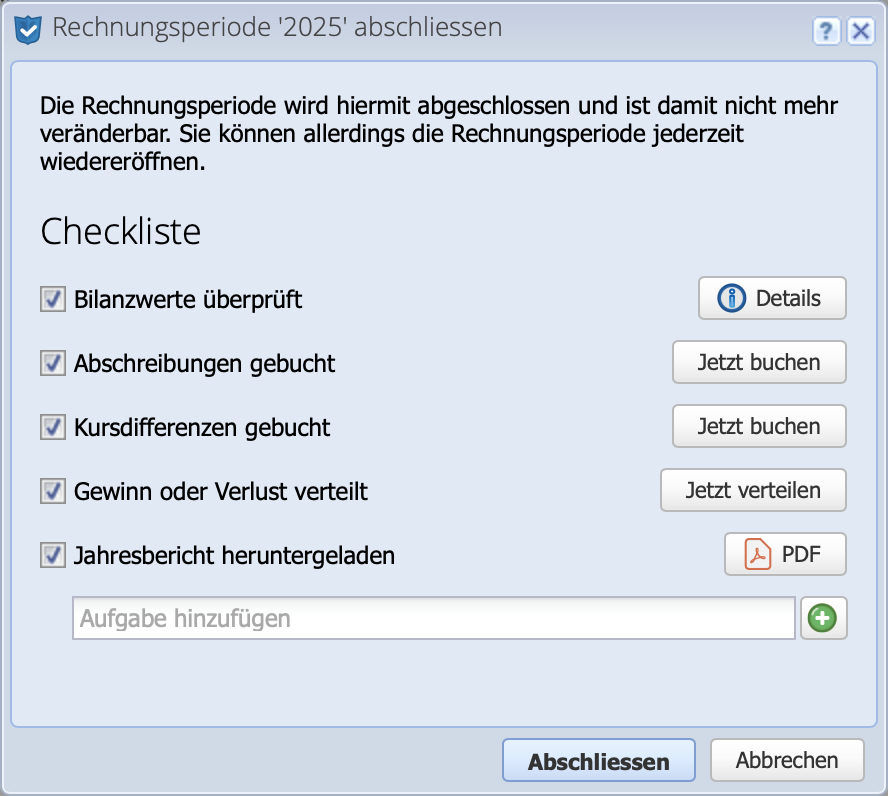

1. Start closing dialog

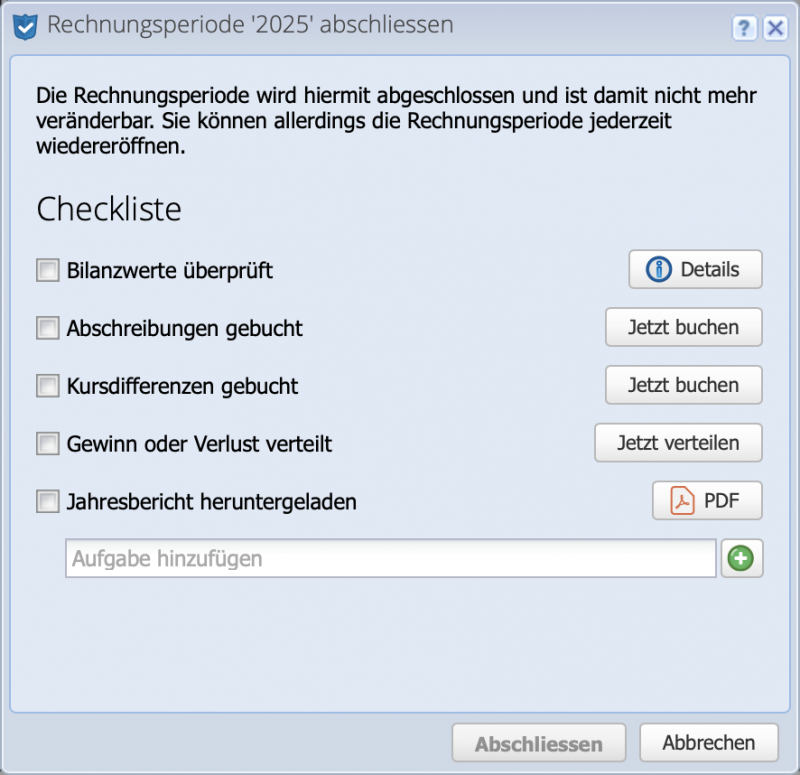

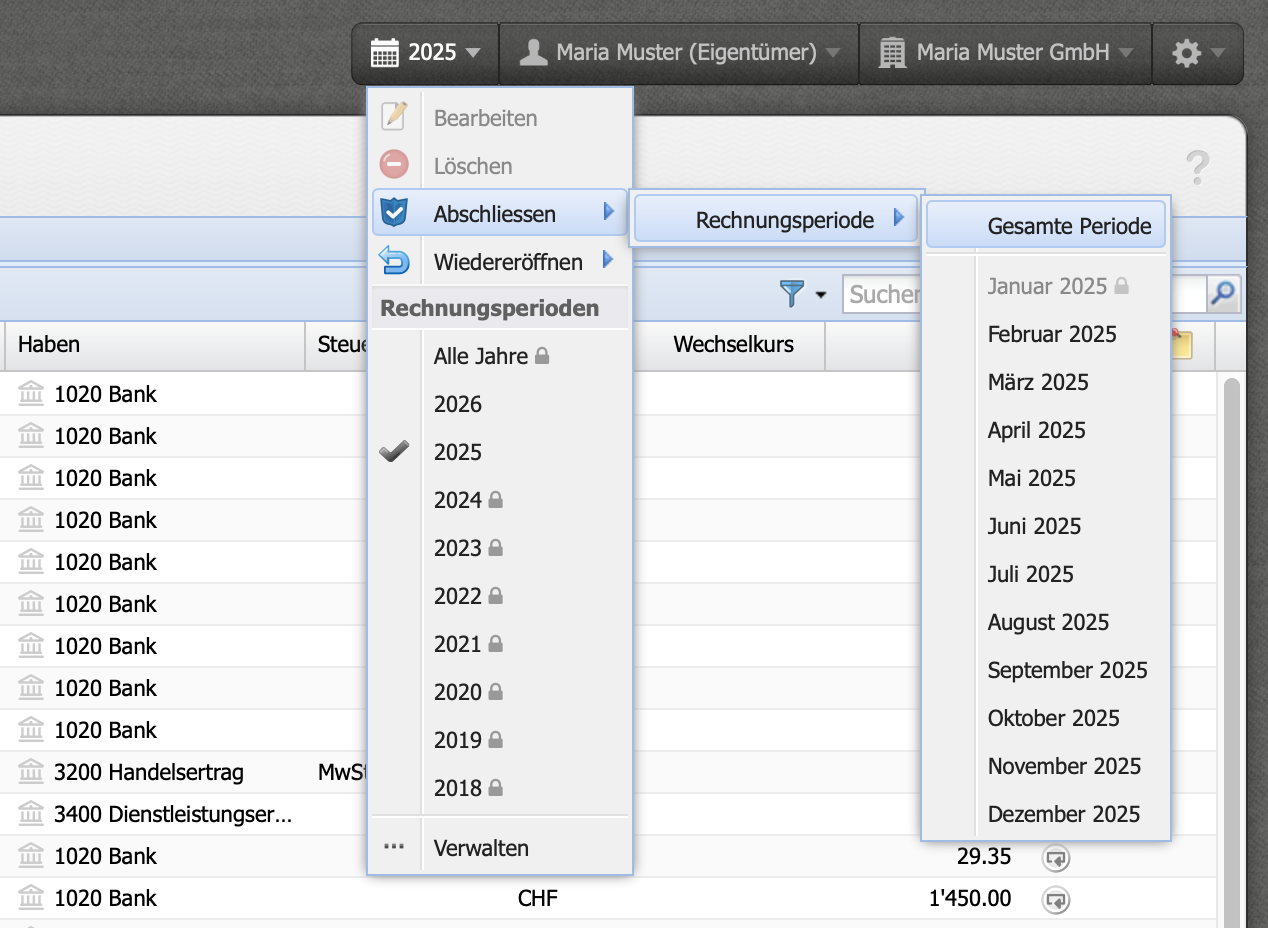

To complete a fiscal period, click on the fiscal year at the top and select Complete fiscal period. The checklist shown gives an overview of what still needs to be done and can optionally be completed with your own tasks.

- CashCtrl automatically checks the balance sheet values and indicates if something does not match.

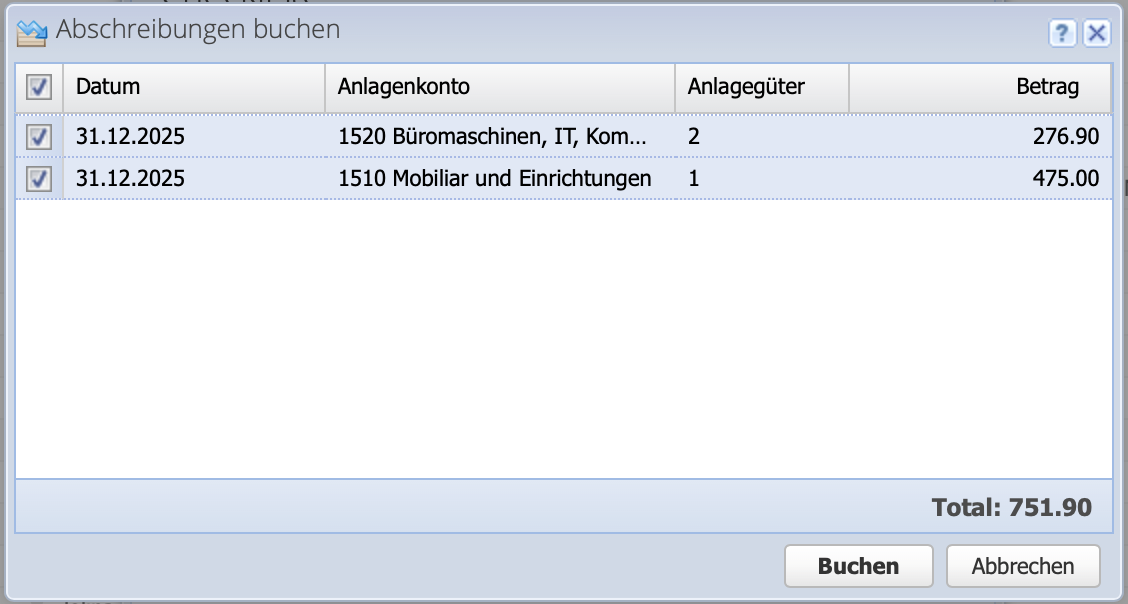

- "Book depreciation" creates the corresponding bookings.

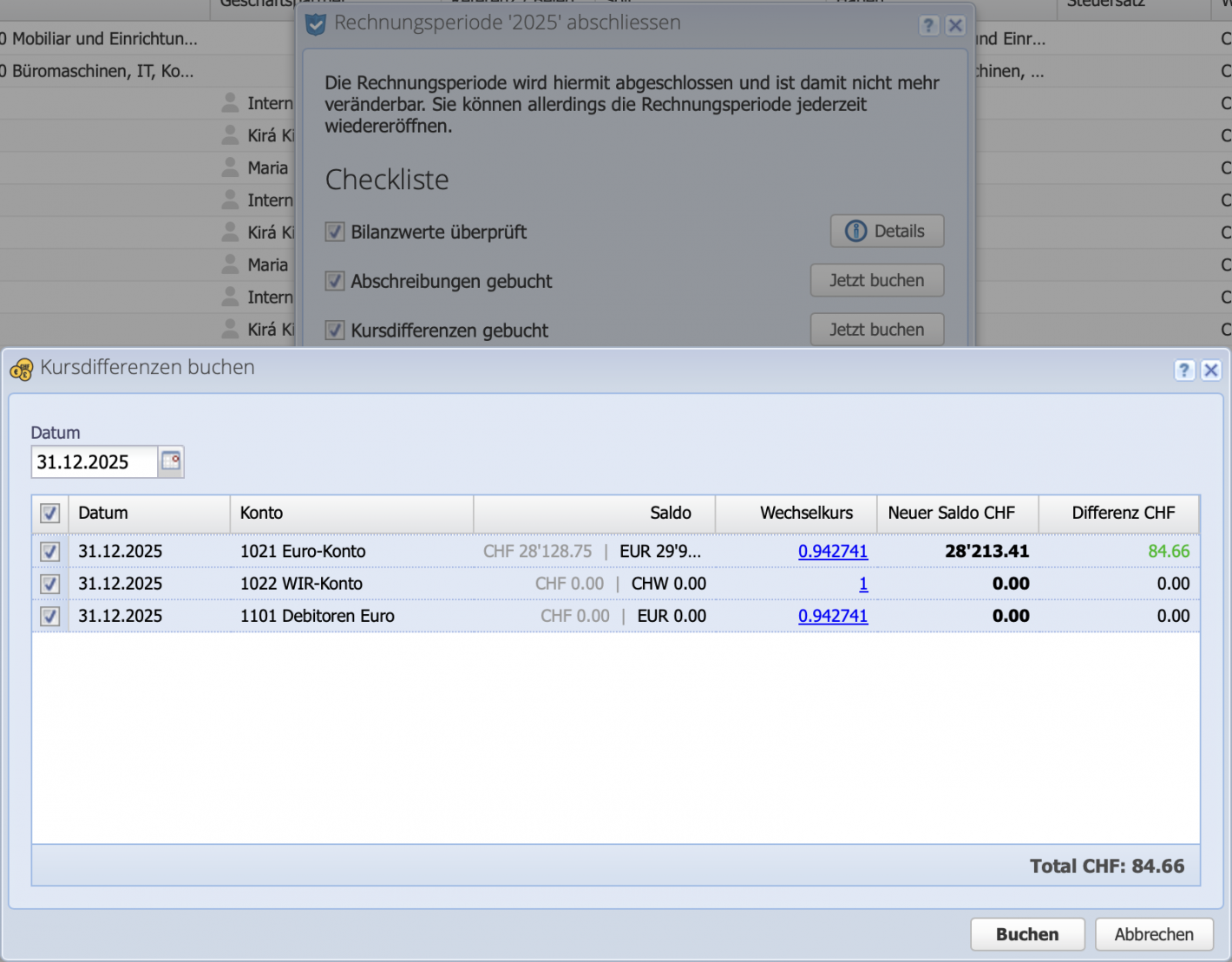

- The exchange rate differences that have arisen over the year are corrected with the current exchange rates.

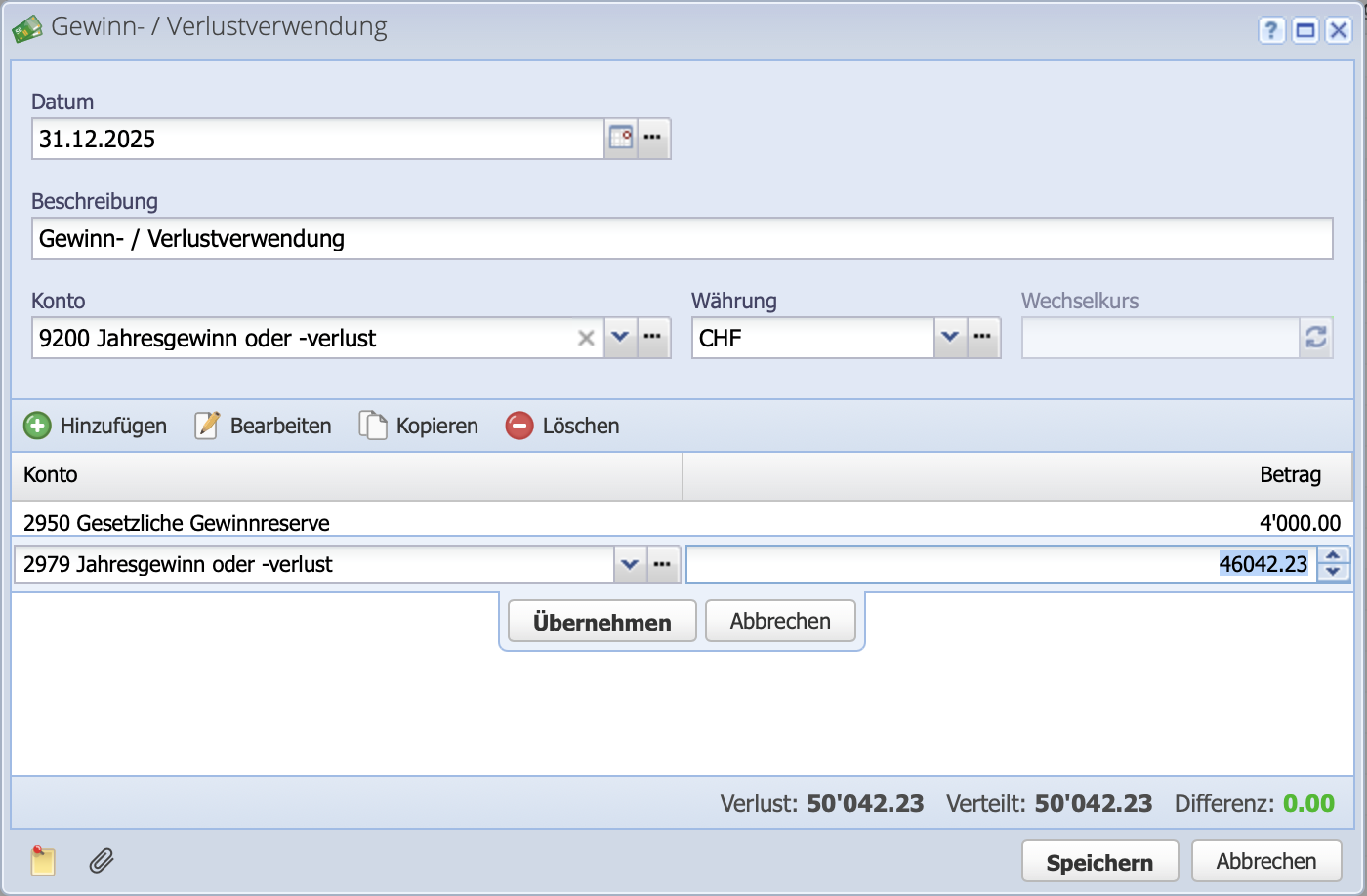

- "Distribute profit and loss" assigns the profit or loss to the desired accounts.

- The annual report is provided as a PDF.

Once all items on the list have been completed, the year-end closing can be executed. CashCtrl thus closes the year or fiscal period and protects it from changes. However, fiscal periods can be reopened if adjustments are still needed.