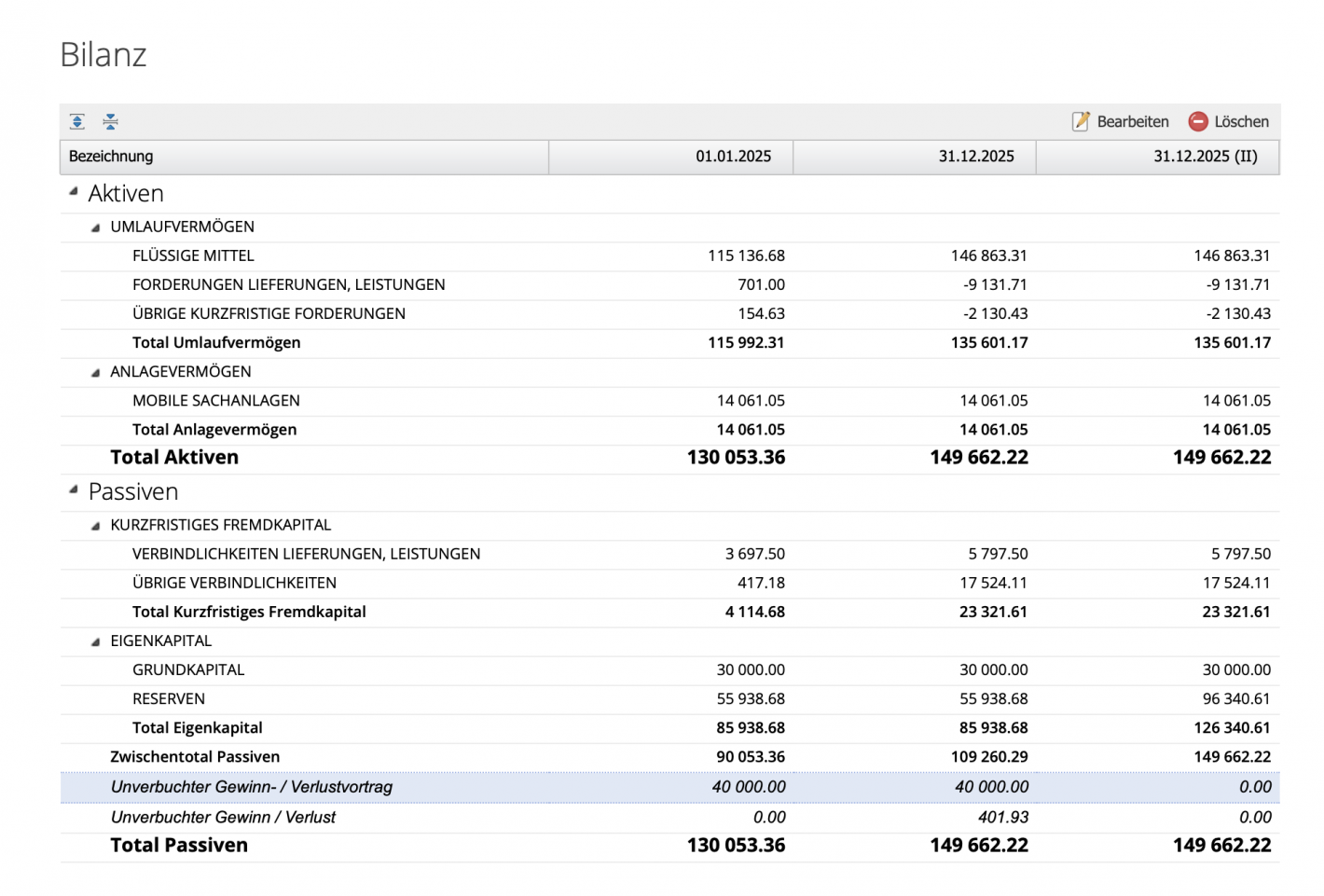

1. Unbooked profit/ loss

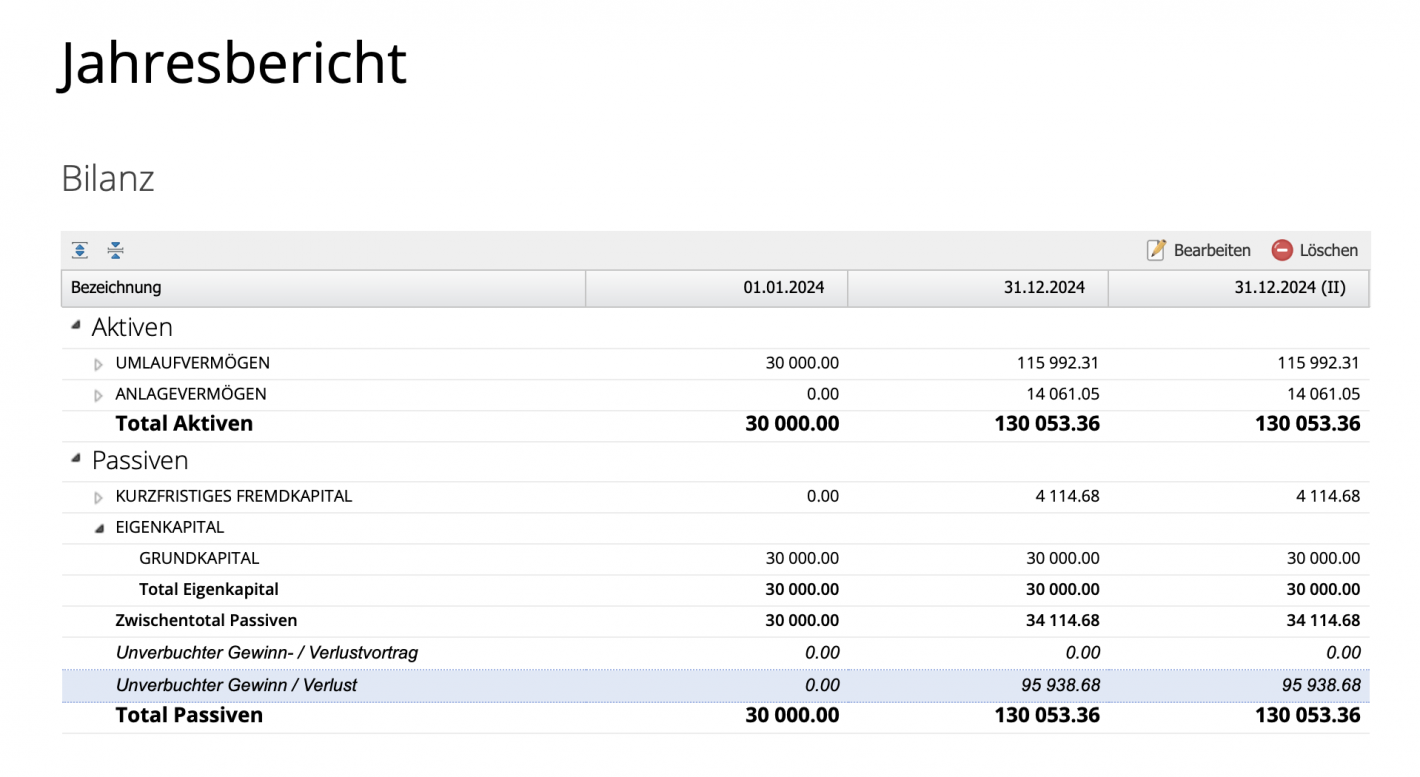

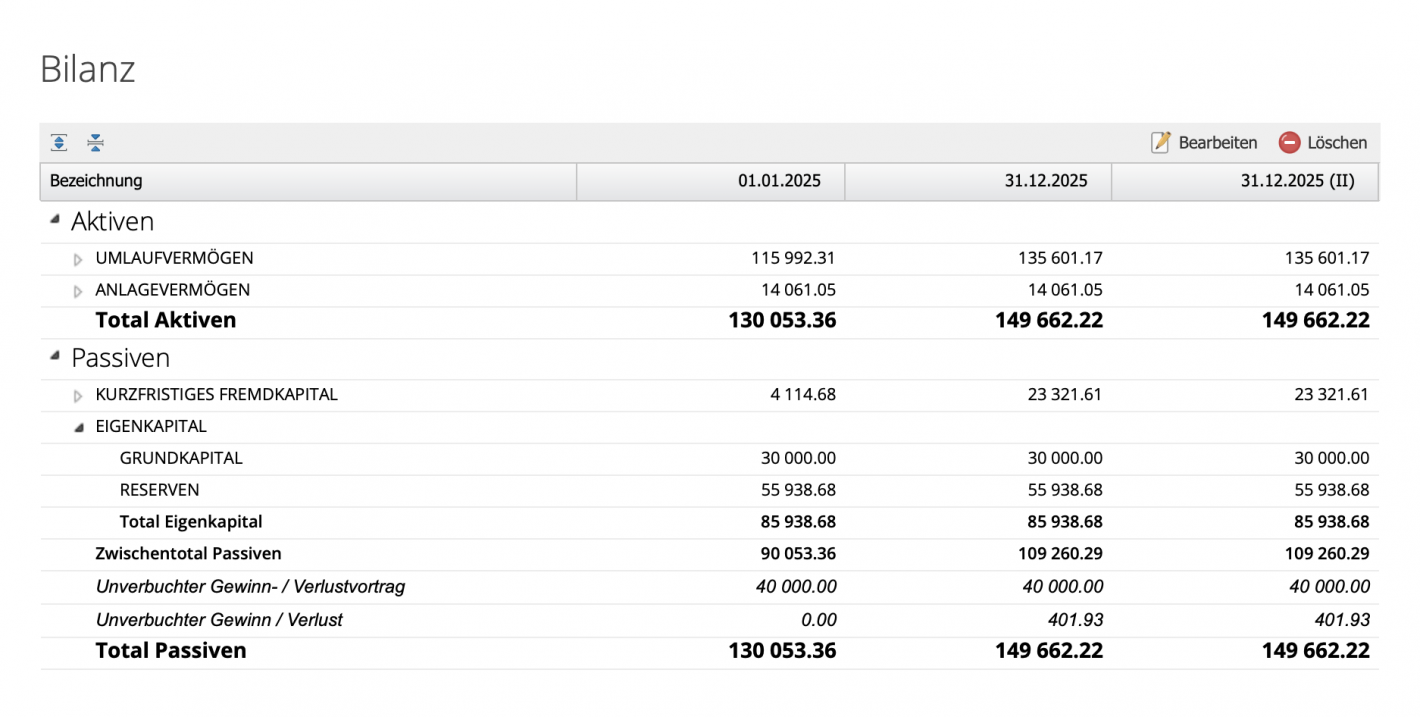

If the profit or loss was allocated in the previous accounting period, the opening amount (January 1) of the line Unbooked profit / loss carried forward and Unposted profit / loss below will be 0.00.

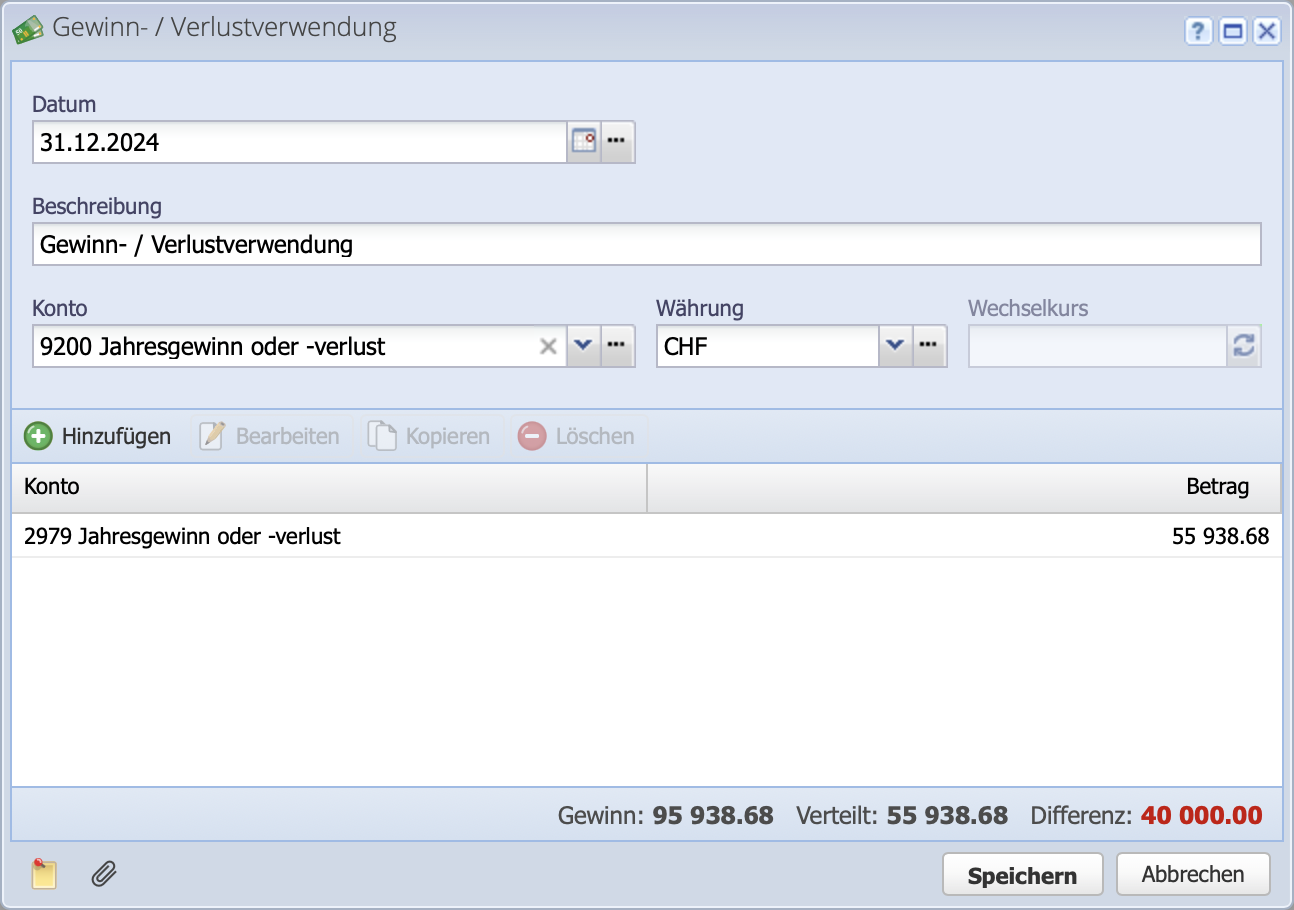

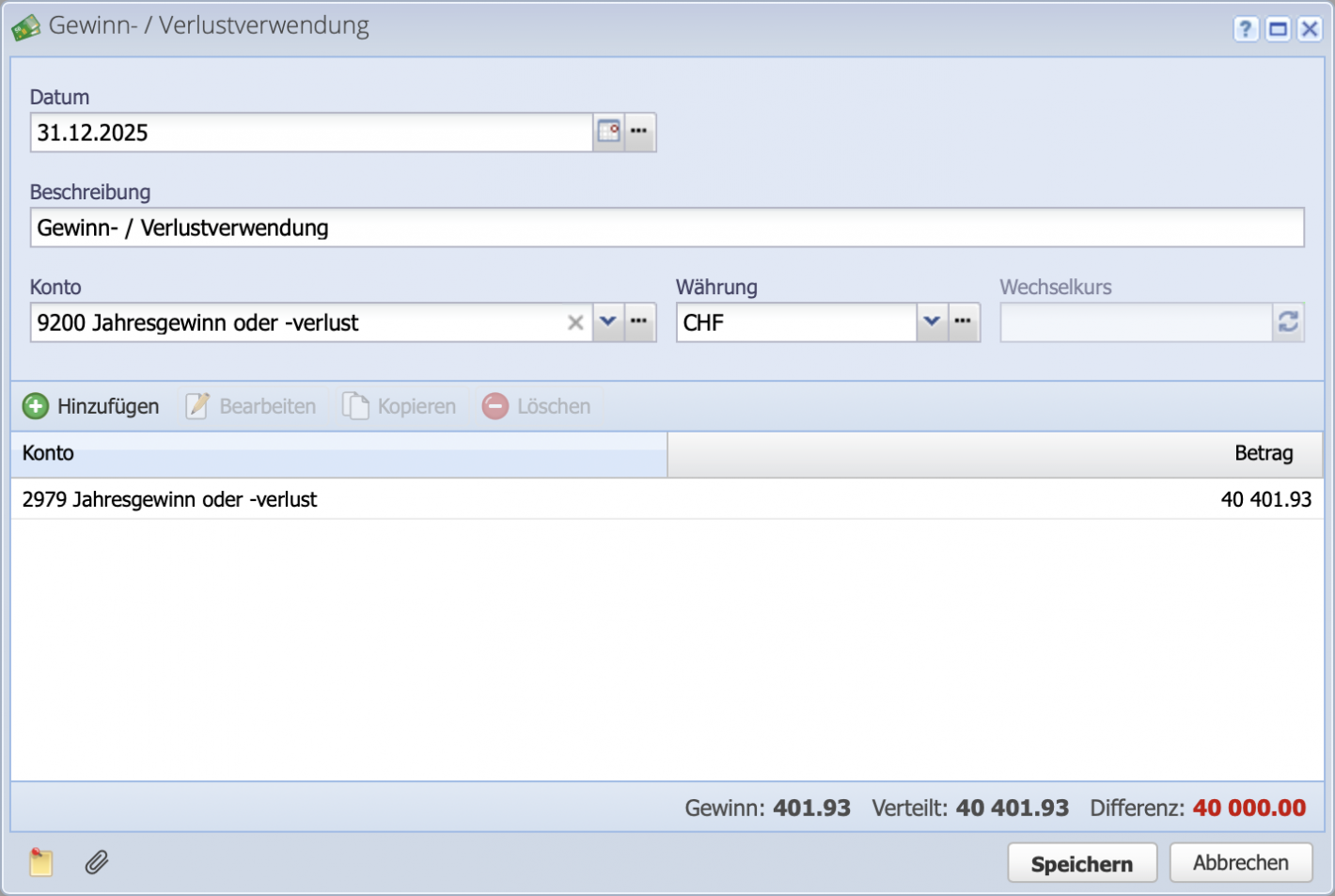

If this has not yet been done, see year end closing tutorial

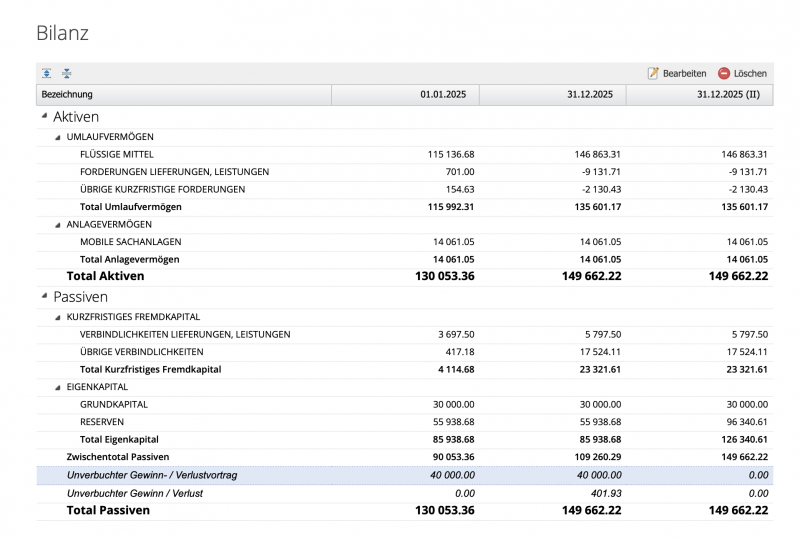

Failure to do so will result in an unposted profit/loss carryforward, see 2.