Net and flat tax rates are used for a simplified settlement with the FTA, because for this purpose the input tax does not have to be determined.

Please enter a search term.

Error ~ No results could be loaded.

Use net tax rate and flat tax rate

Tutorial: Configure tax rates correctly for the different VAT settlement methods and work with net or flat tax rates.

Content

- Enter net tax / flat tax rate

- Assign revenue account

- Create invoice document or book manually

- Evaluation by tax rate

- Good to know

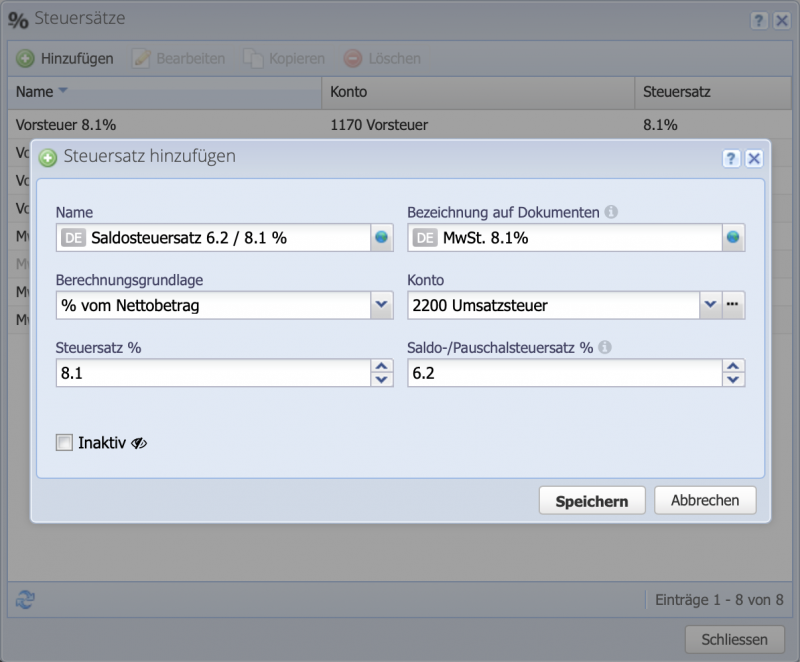

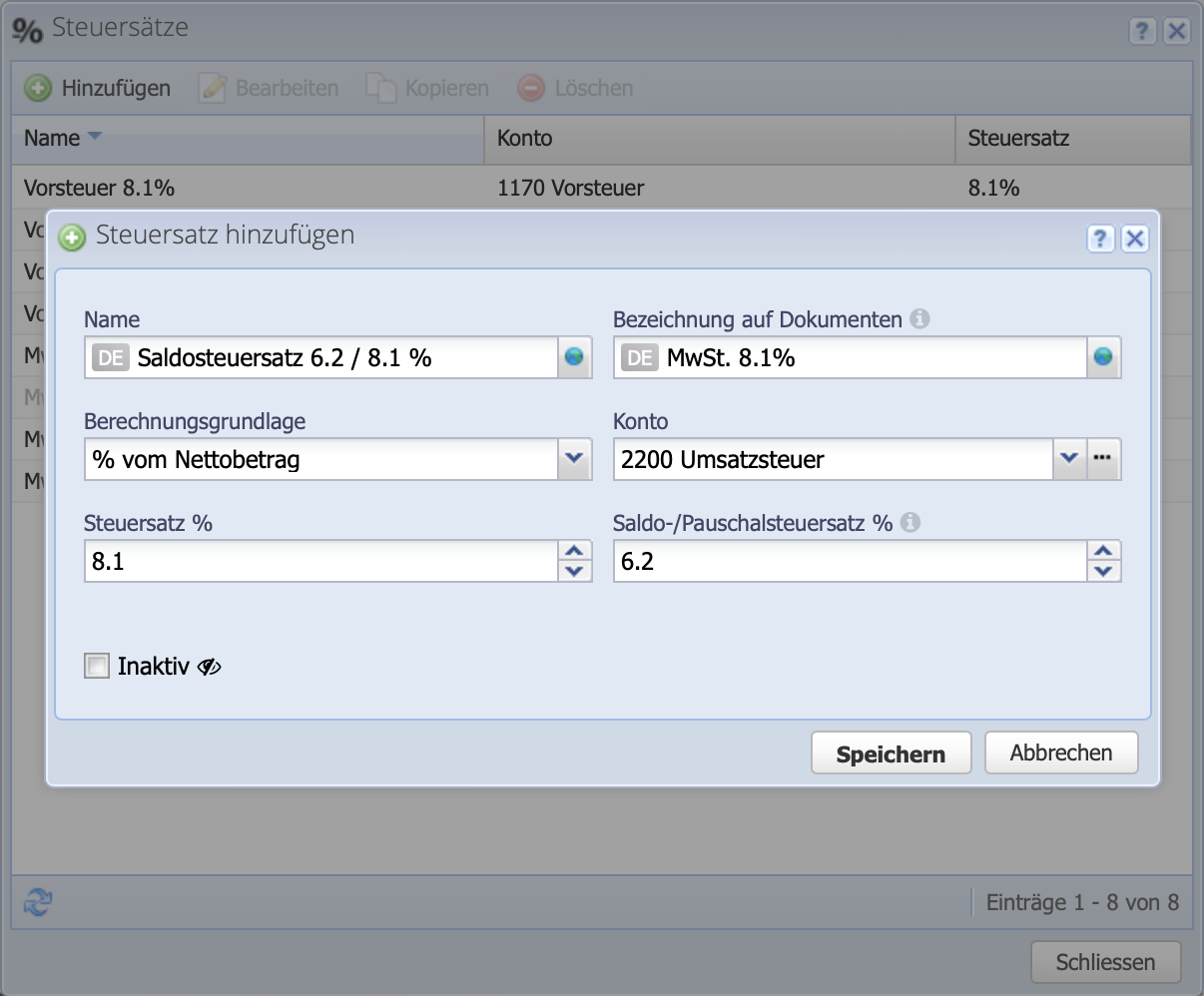

1. Enter net tax rate

Enter a new tax rate under Settings Tax rates / Add. In order to configure a net tax rate, you only need to fill in the field Net/flat tax rate %. Any number of rates can be entered and applied.

If the rates change, existing rates can be switched to inactive and new tax rates can be entered. Rates that have already been used cannot be adjusted/deleted.

CashCtrl does not provide rates, changes are only adjusted by users.

2. Assign revenue account

As with the regular tax rates, the net tax rates are also assigned to accounts. This is set in the Accounts module by double-clicking on the corresponding revenue account.

Once a tax rate is assigned, it will be pre-filled in order documents for the income from items in the corresponding income accounts.

Only one rate can be assigned per account. Therefore, if services or items with different rates are sold, a revenue account must be created for each tax rate.

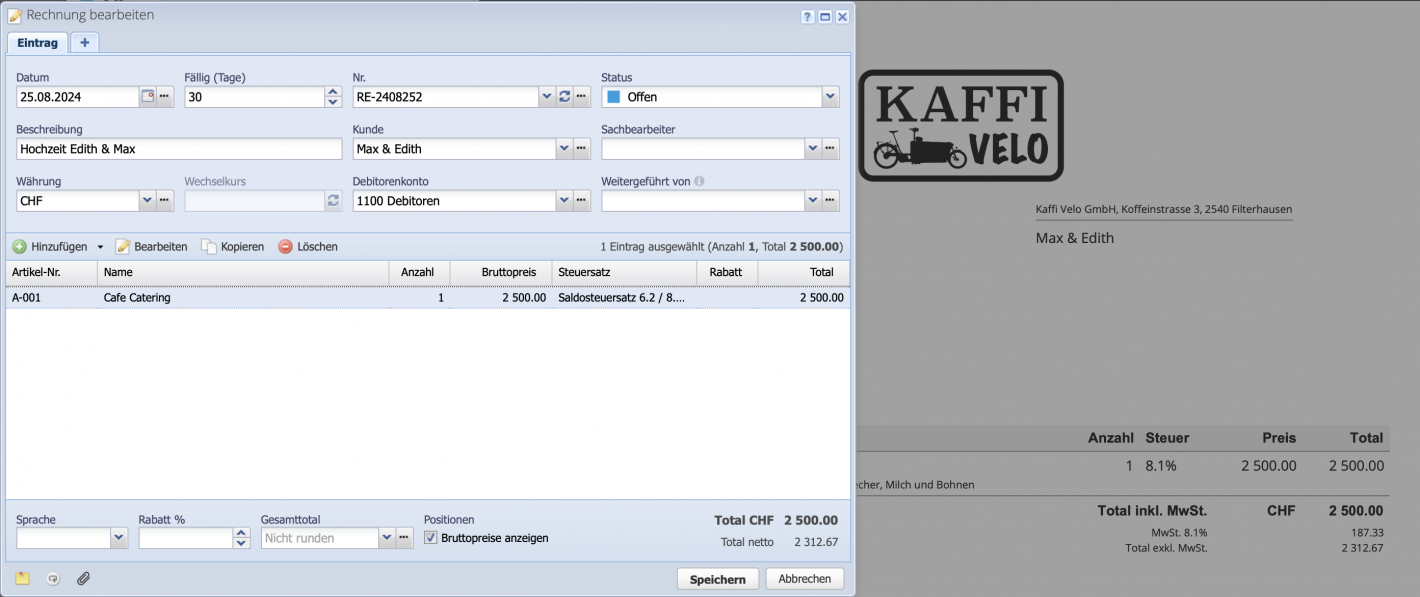

3. Create invoice document or book manually

On invoice documents the assigned rates are automatically applied. On the document, VAT is listed at 8.1%, while at the same time CashCtrl calculates for payment to the tax authority at the reduced rate in the background.

The same applies to manual entries in the journal. For entries with a net/ flat tax rate, the stored rate is automatically applied in the dialog.

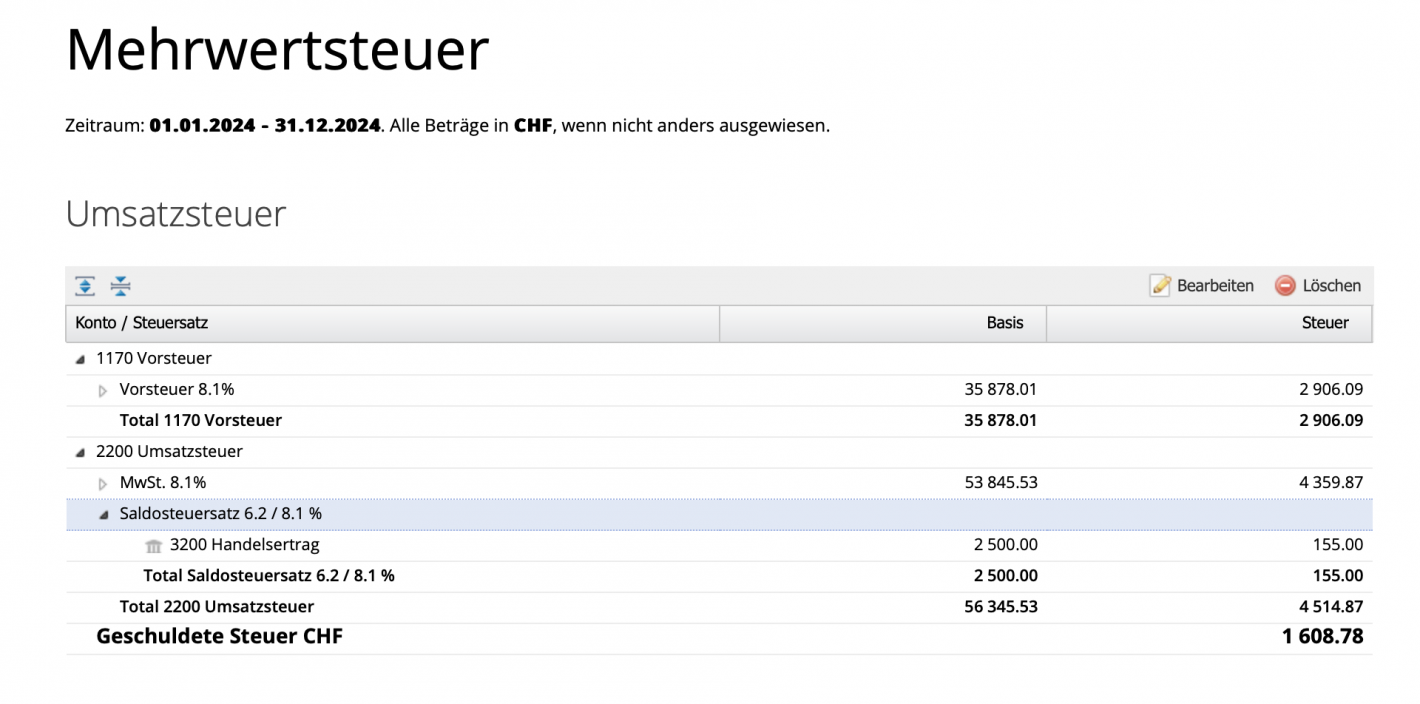

4. Evaluation and payment of VAT

In the VAT report, the individual tax rates are broken down so that they can be transferred to the tax authority form.

The total due is then paid as a transfer to the tax authorities and booked against the account (default: 2200 VAT). This decreases the balance of the account.

Good to know

- How the VAT report works: The VAT report always shows the calculated VAT for the selected period, but not the balance of the VAT account (by default account 2200 VAT) and whether payments have already been made to the tax authority.

- The tax rates for net or flat-rate taxation are industry-specific and can be viewed on a list from the federal government. Whether balance tax rates or flat tax rates can be applied must first be clarified. The following page of the Swiss Federal Tax Administration provides information on this: Federal Tax Administration FTA