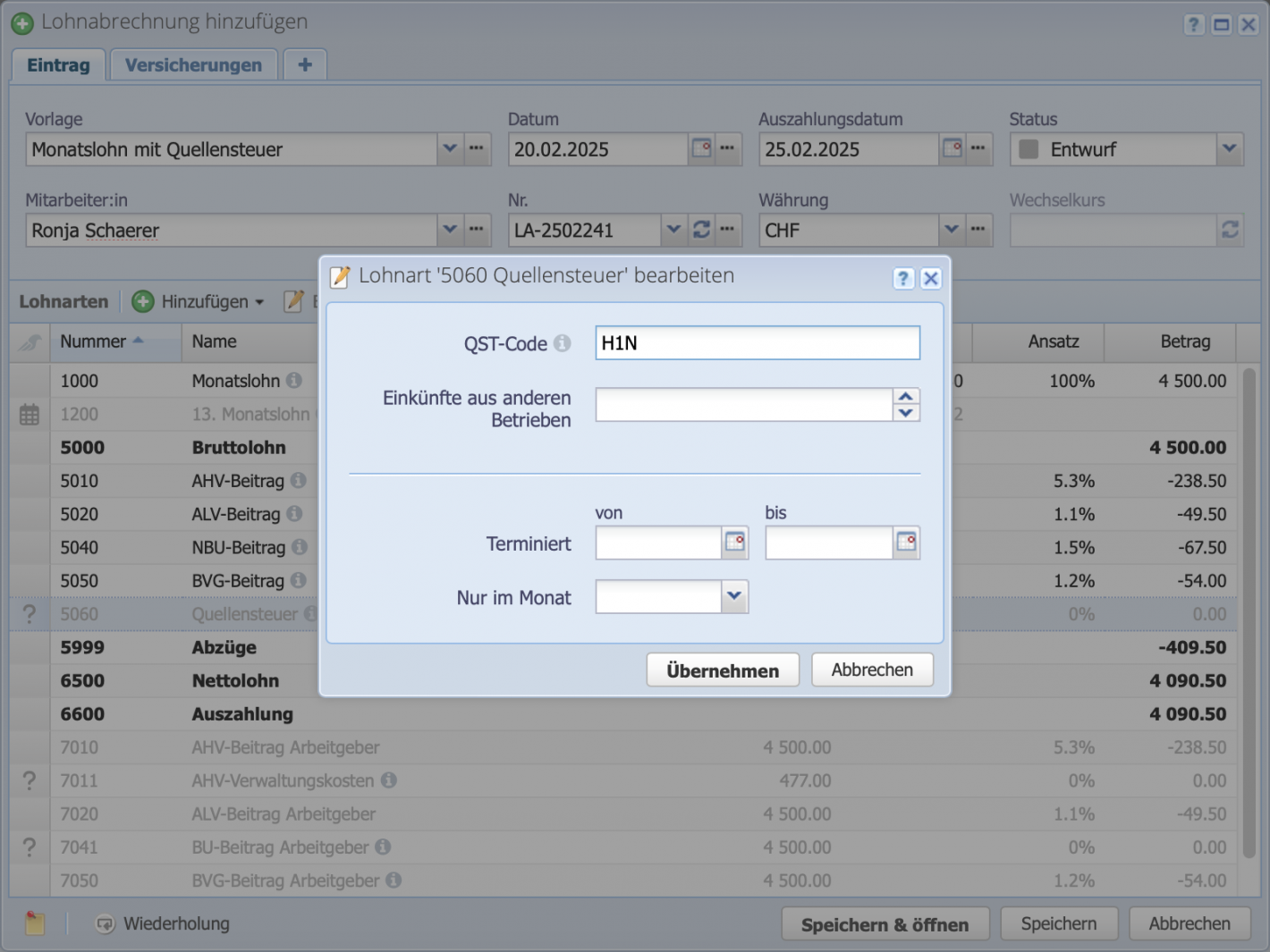

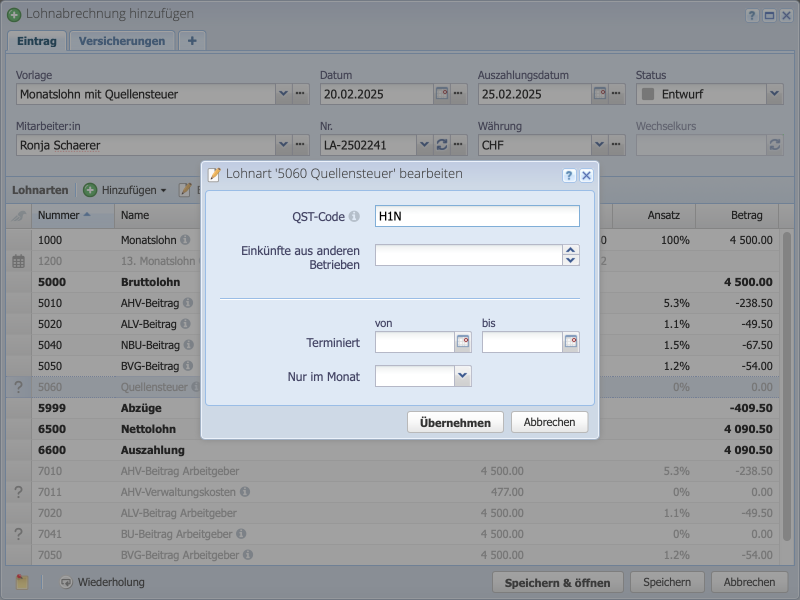

Withholding tax code: If a person subject to withholding tax is hired, this must be reported to the cantonal tax authority or municipality. After review, the corresponding withholding tax code will be communicated.

Please enter a search term.

Error ~ No results could be loaded.

Withholding tax

Tutorial: How to use withholding tax on payroll statements.

Contents

- Enter canton for person/place of work

- Create payroll statement

- Enter monthly salary or hourly rate

- Configure withholding tax

- Save and send payroll statement

- Withholding tax statement

- Good to know

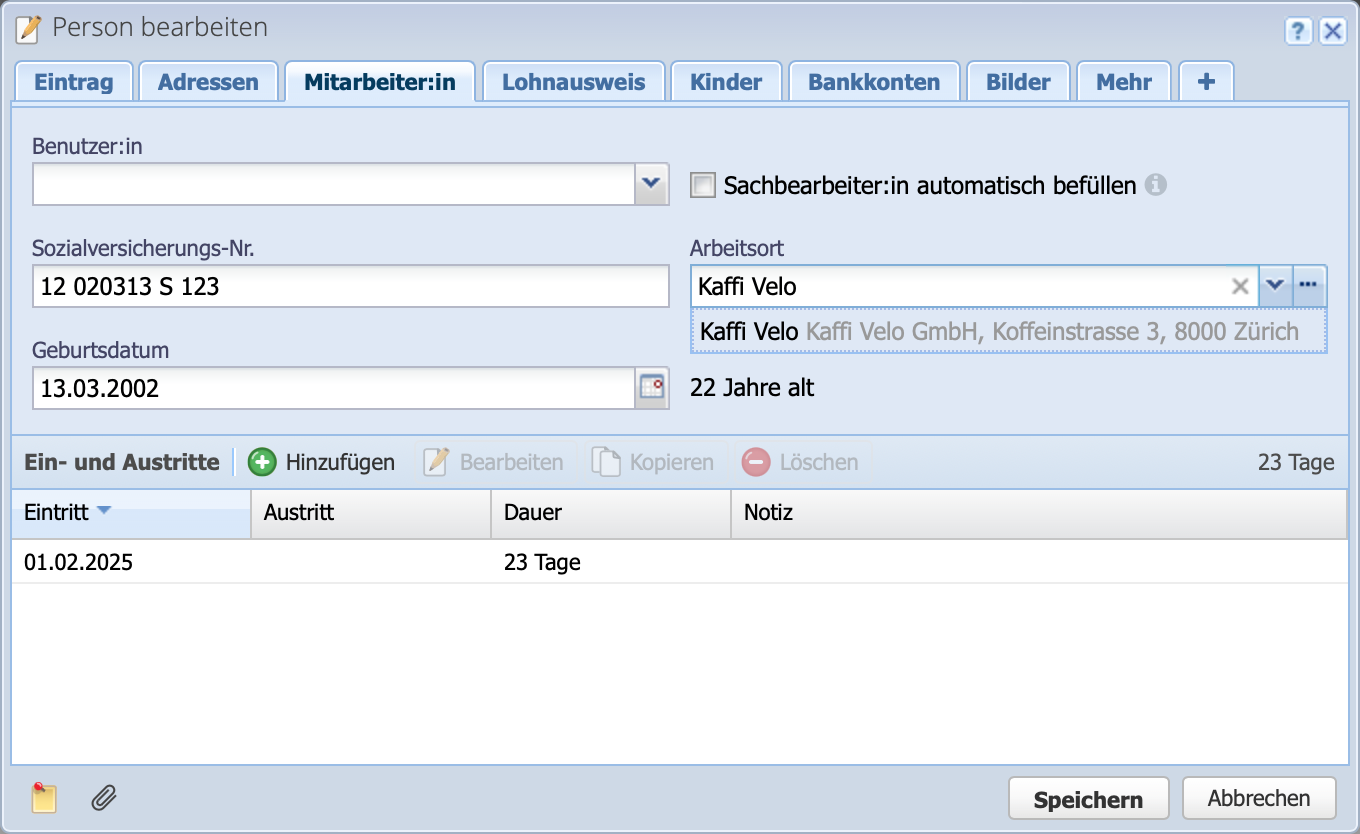

1. Enter canton for person/place of work

In order for the withholding tax to be calculated correctly in the payroll accounting, a place of work must be defined for the employee. This can be checked in the Persons area by editing the contact in the Employee tab. A location must be selected in the Place of work field.

At the same time, the location can be opened by clicking on the ... menu next to the Place of work field. Check here whether there is a value in the Canton field or add one if necessary.

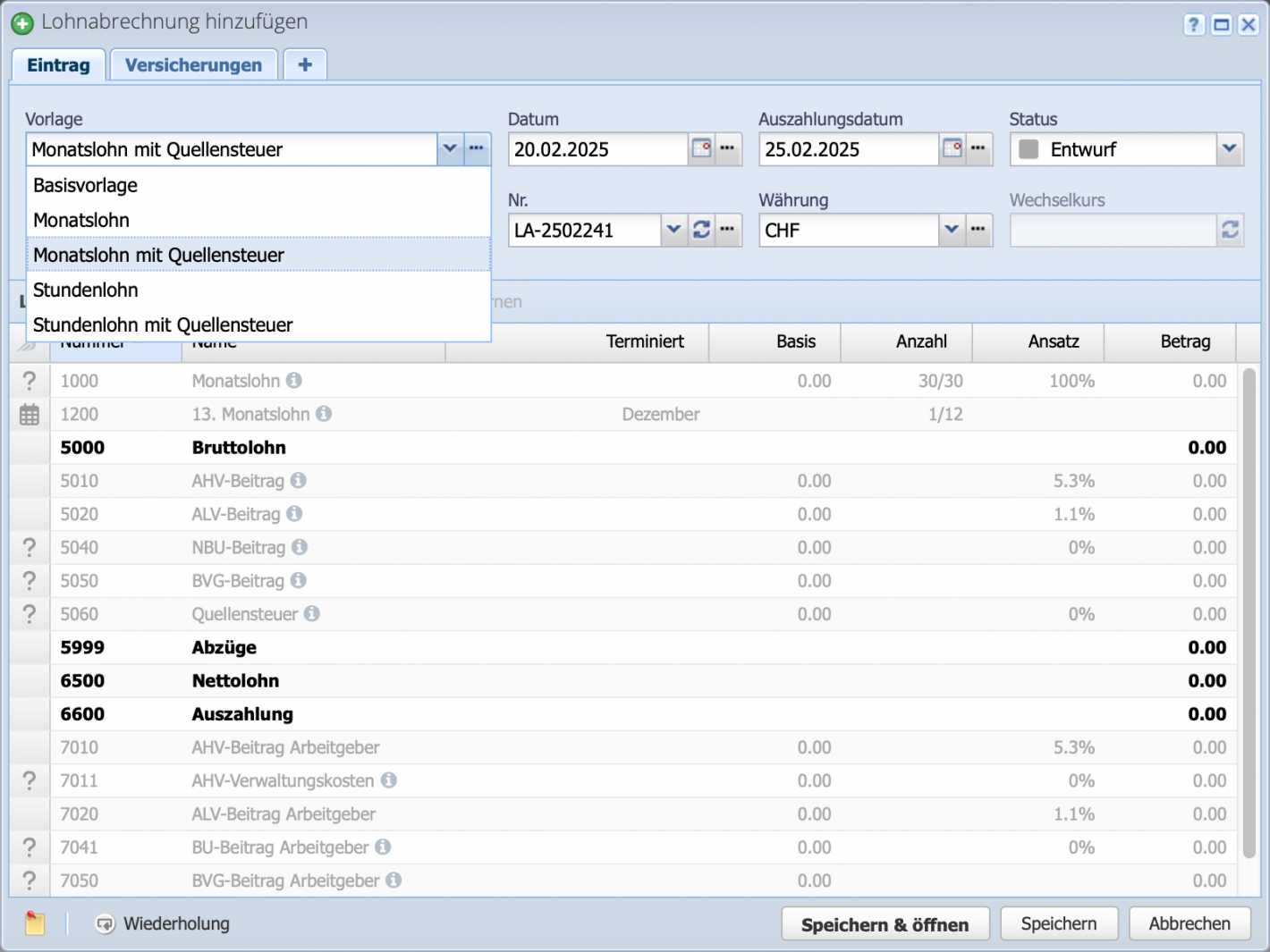

2. Create a payroll statement

In the Salaries section, click Add to open a new payroll statement. First, select a salary template with withholding tax. There are two preconfigured salary templates:

- Monthly salary with withholding tax

- Hourly wage with withholding tax

Go to the salary template tutorial to configure salary templates yourself as desired.

Next, select an employee.

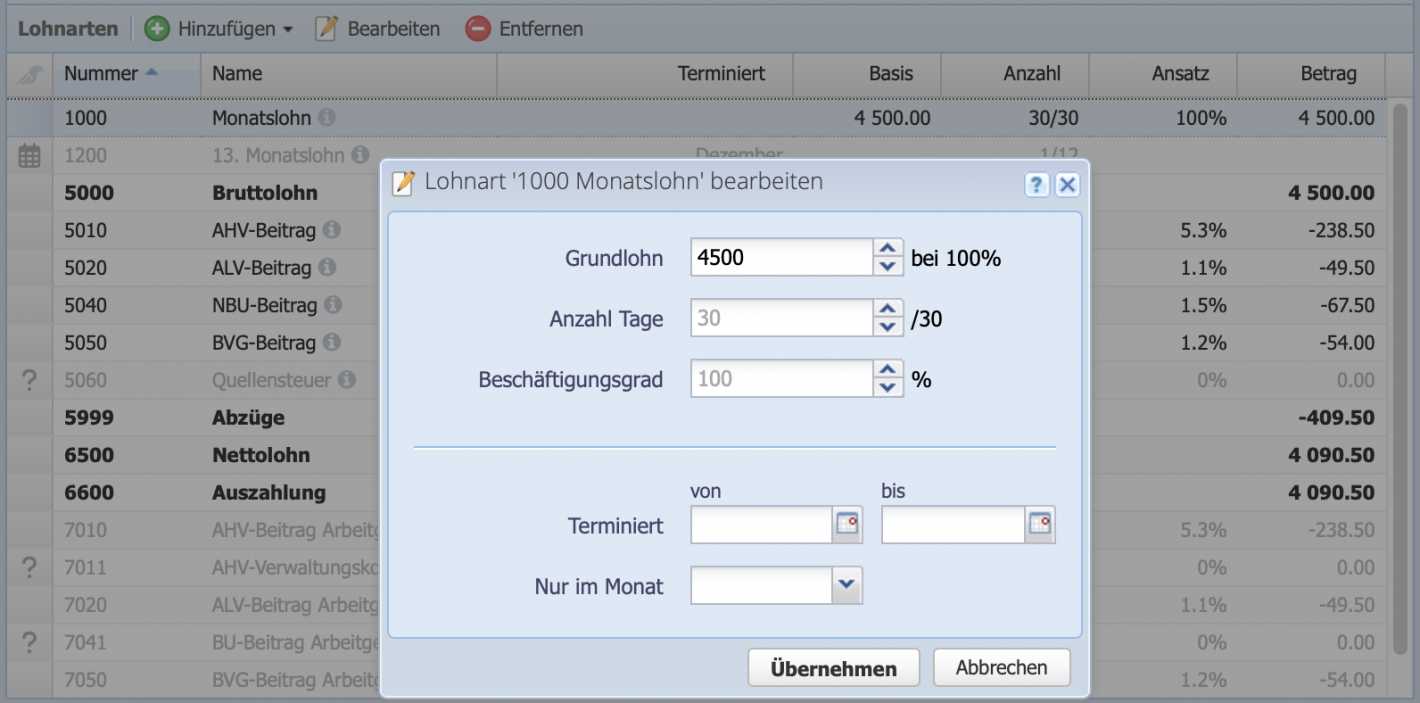

3. Enter monthly salary or hourly wage

Double-click on the initially grayed-out salary type to edit it. You can now enter the monthly salary or hourly wage here.

You can also add deductions and allowances. For more information, see the hourly wage tutorial or monthly salary tutorial .

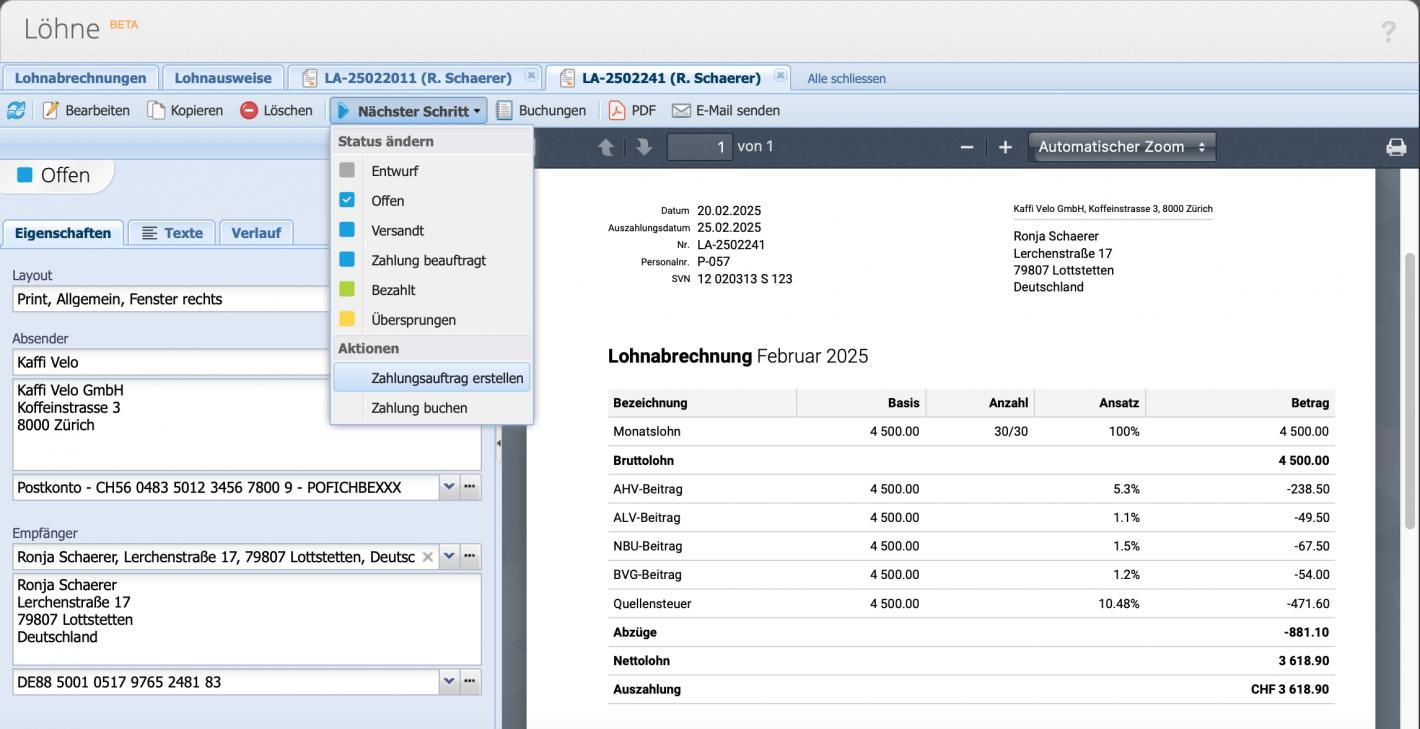

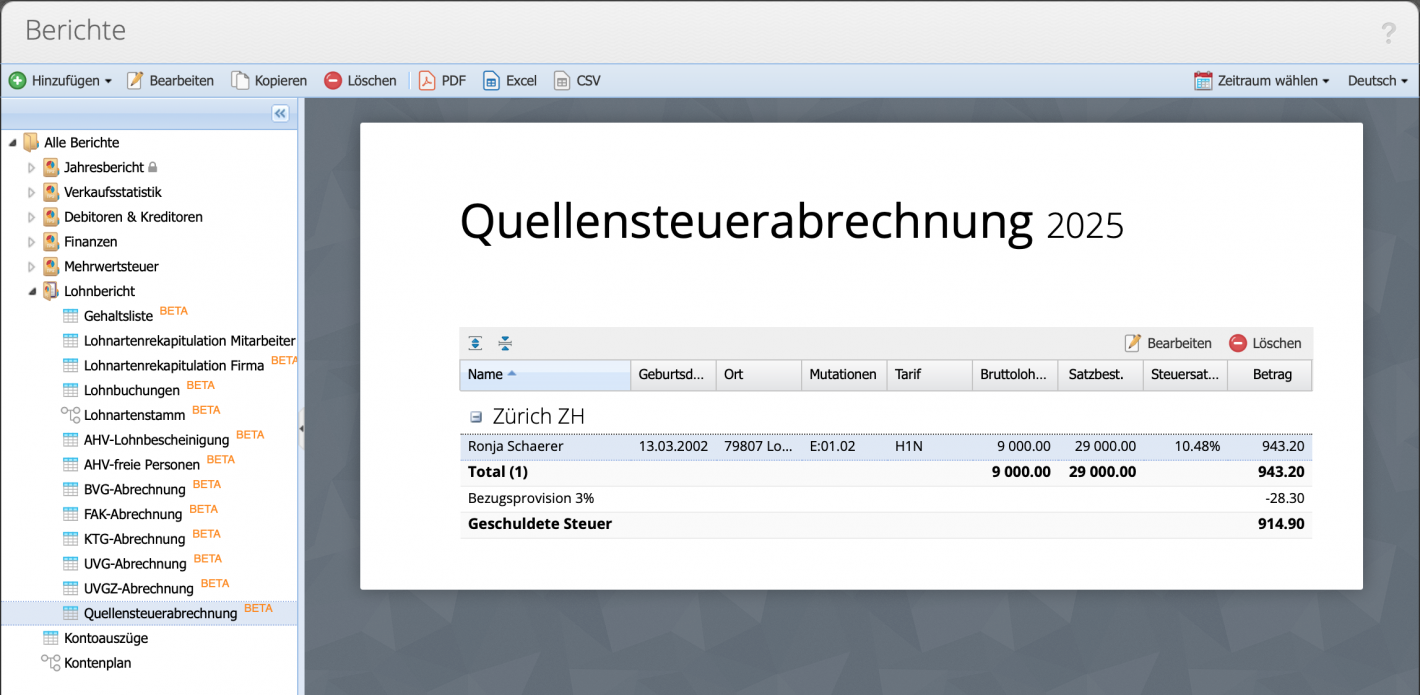

6. Withholding tax statement

The withholding tax report is already available in the Salary report collection. Here, the salary statements that have been paid are listed by canton. The tax amount owed can be viewed here.

Via Edit, the commission (%) can be adjusted and a filter can be set for each canton.

Good to know

- The withholding commission: is a fee that an employer or a paying agent (e.g., a company) receives for collecting and paying withholding tax to the tax authorities.

- The withholding tax rates report lists all tax rates for the respective salaries. It can be generated by canton and withholding tax code.

- The structure of the withholding tax code, e.g., “H1N,” is simple:

1st digit – Marital status & children

A → Single

B → Married, both working

C → Married, only one person working

H → Single parent with children (eligible for support)

2nd digit – Number of children eligible for tax deduction

0 → No children eligible for tax deduction

1, 2, 3 ... → Number of children eligible

3rd digit – Parish tax / religion

Y → With church tax portion

N → Without church tax portion