1. Base Template and Inheritance Principle

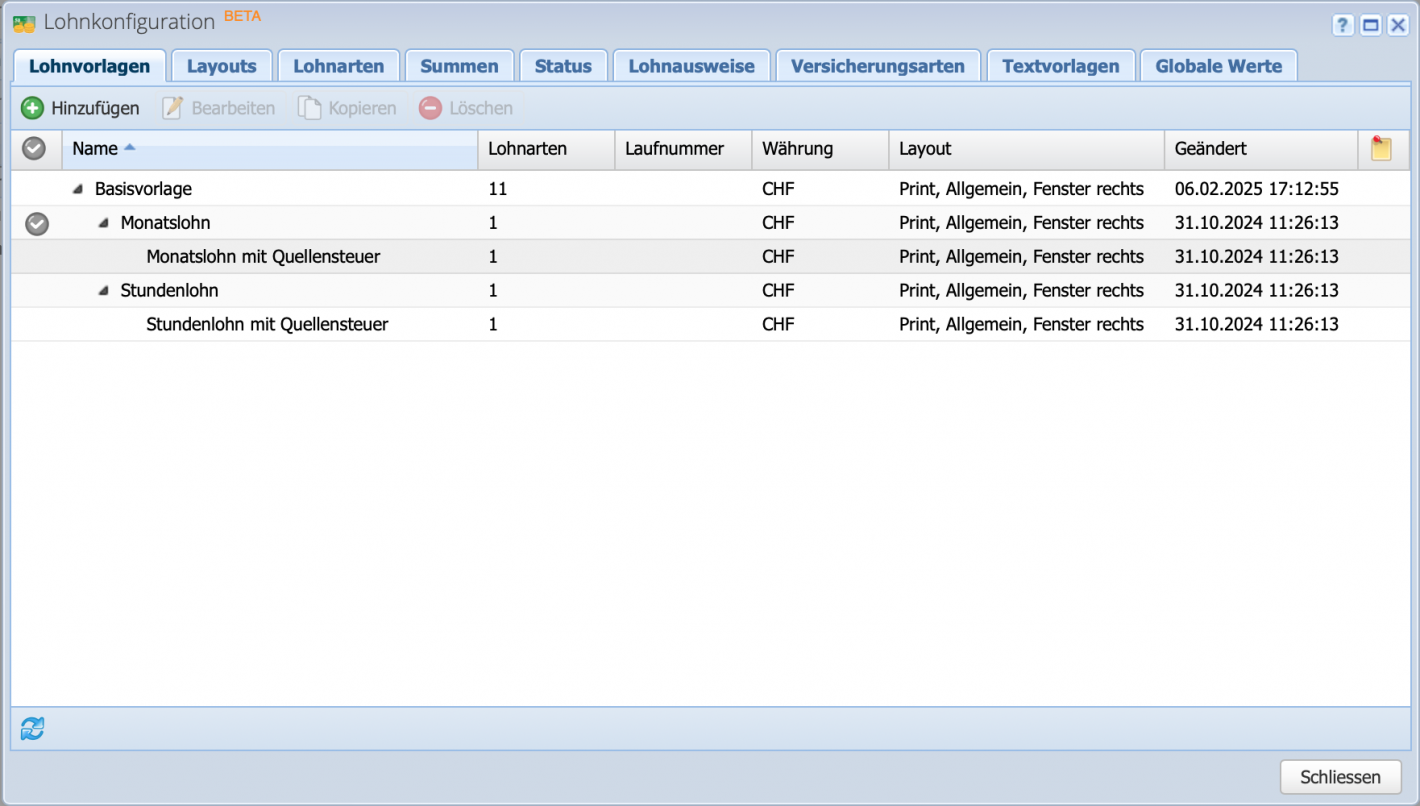

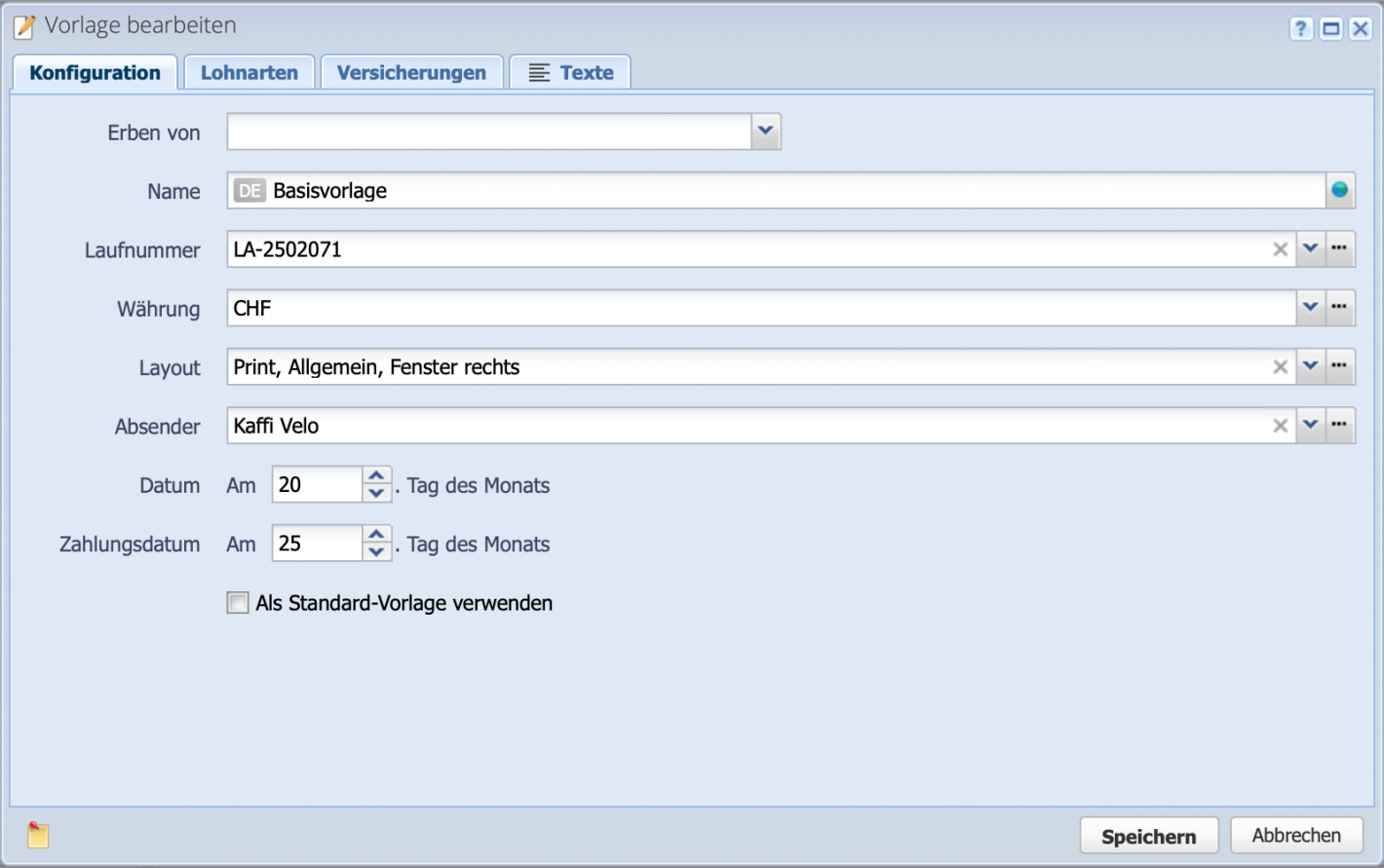

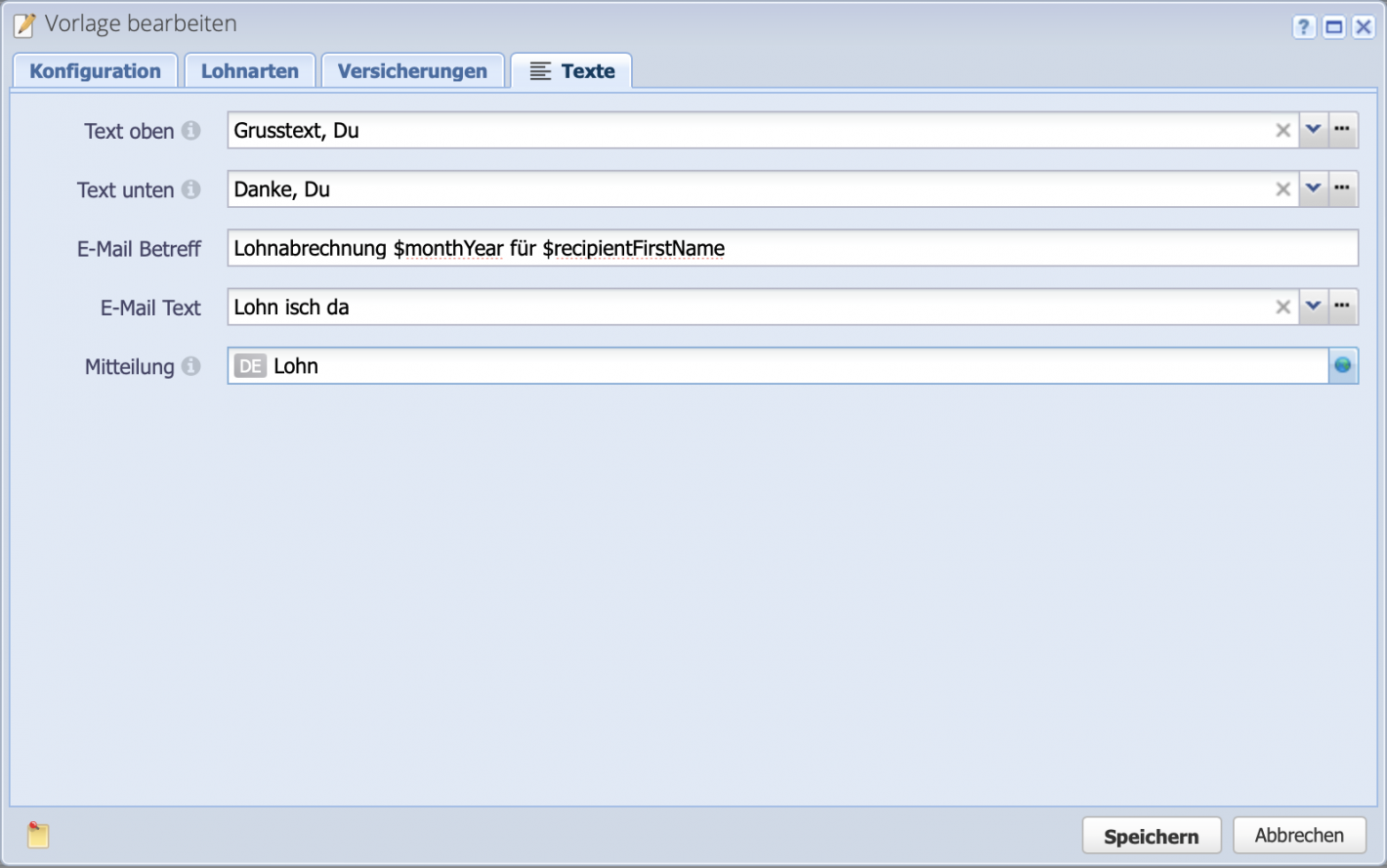

Open the payroll configuration via Settings Payroll Configuration (or directly under Payroll via More Configuration). In the first tab Salary Templates, the default templates are displayed.

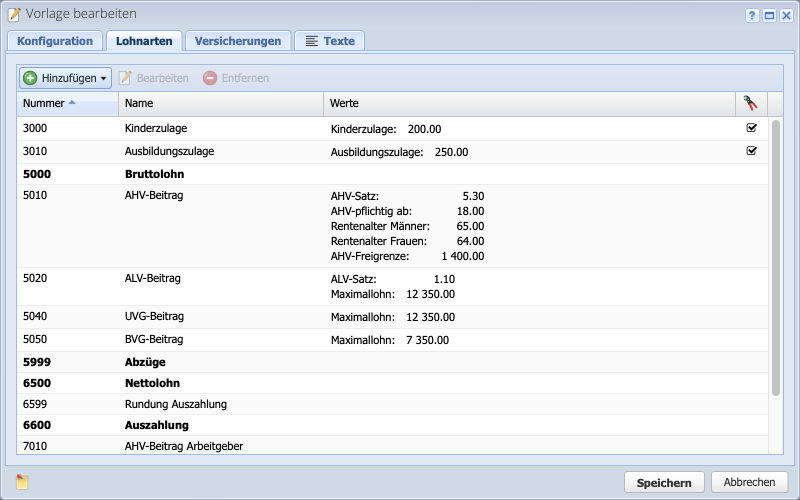

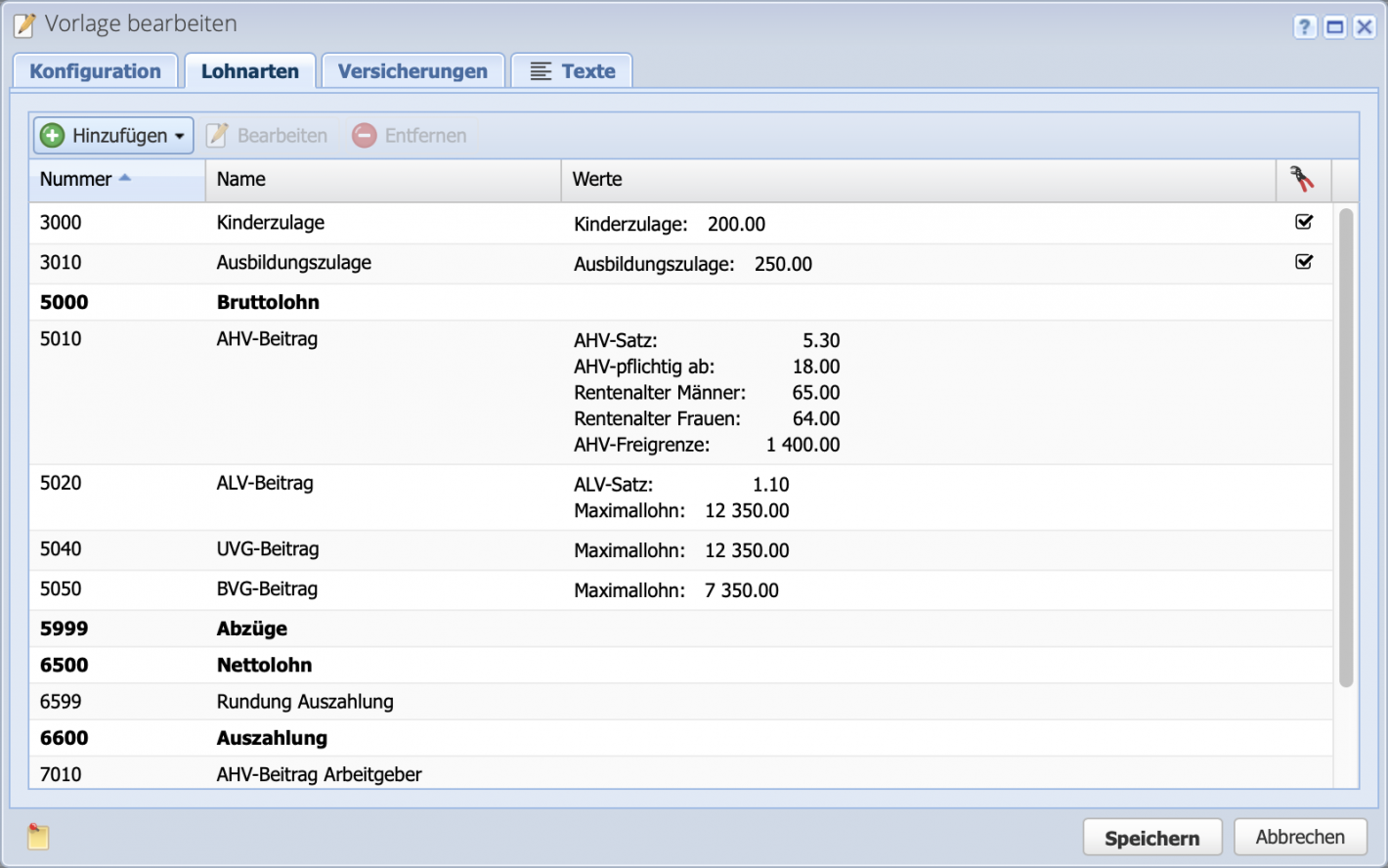

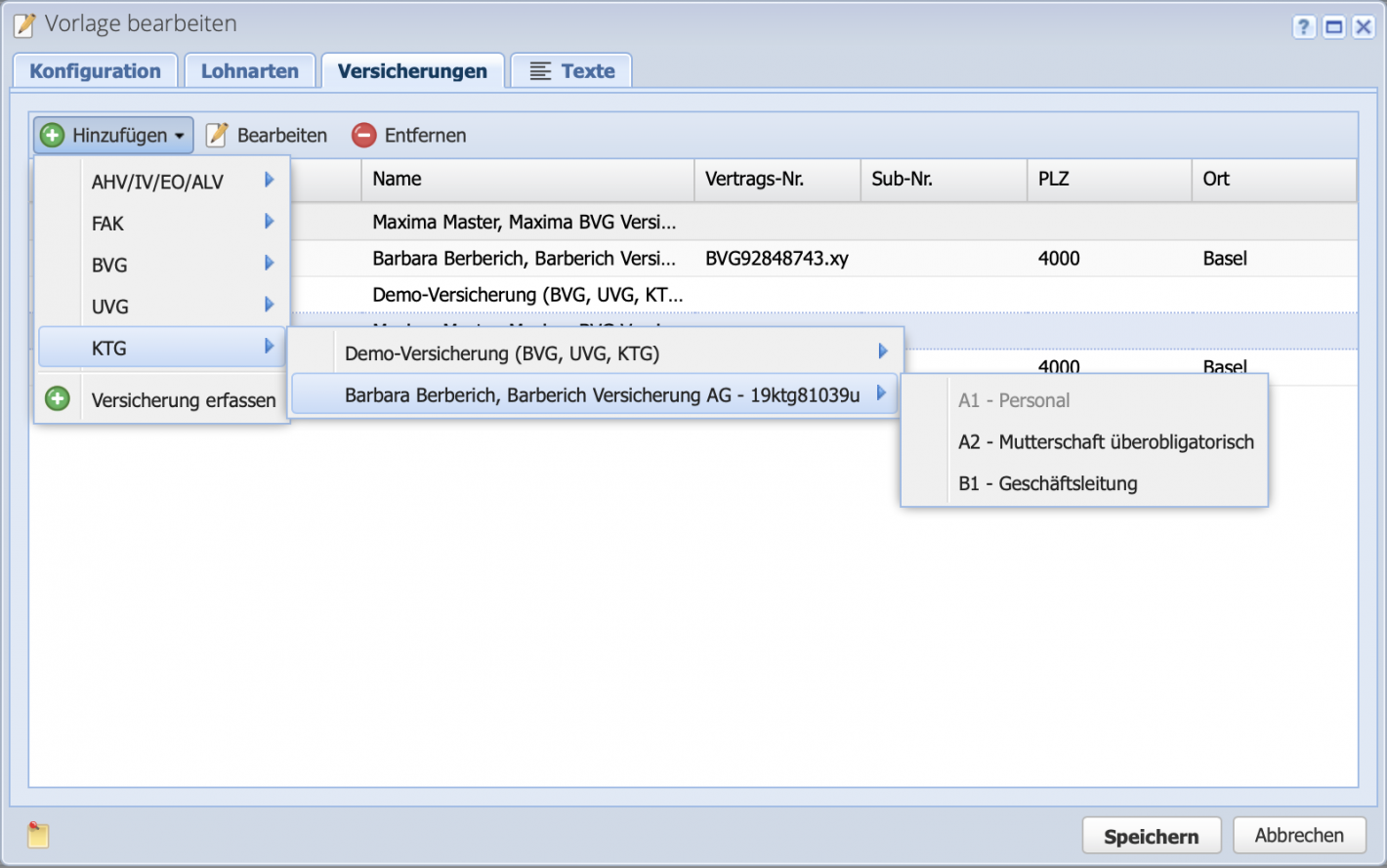

Salary templates follow an inheritance principle. Indented templates in the tree automatically inherit from the parent template. For example, a basic setting such as an insurance can be defined in the Base Template, making it apply to all subordinate templates. If there is a specific insurance that only applies to hourly salaries, it can be overridden in the “Hourly Salary” template.

There can be multiple base templates (also under different names).