Changes without repetition

If payroll statements are created manually, all adjustments can be entered and applied directly in the next statement. No additional steps are required.

Please enter a search term.

Error ~ No results could be loaded.

Payroll accounting tutorial: How to make changes to payroll statements. Enter salary types such as bonuses, allowances, or workload adjustments directly. All explained in a few easy steps.

Contents

If payroll statements are created manually, all adjustments can be entered and applied directly in the next statement. No additional steps are required.

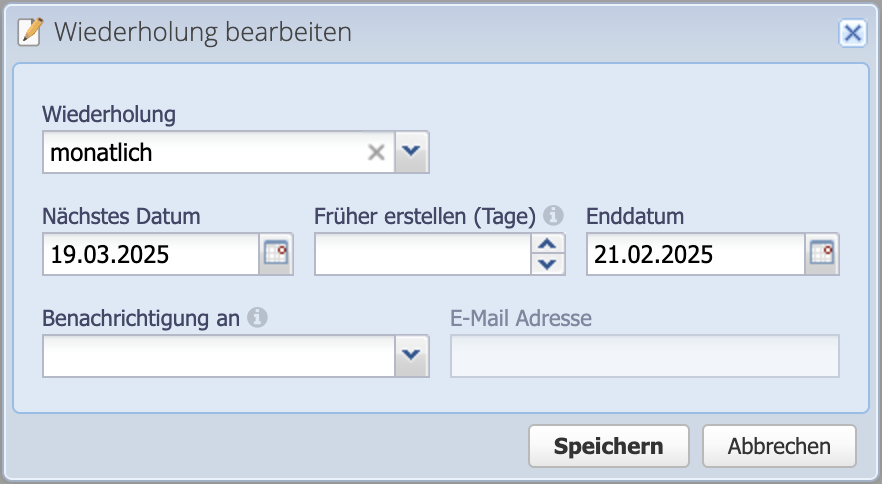

When adjusting payroll statements with recurrences, it is important that the most recent draft is adjusted. This ensures that the changes are applied and the recurrence continues to run.

The default settings for recurrences in CashCtrl are:

This allows the statement to be processed from the 1st of the month.

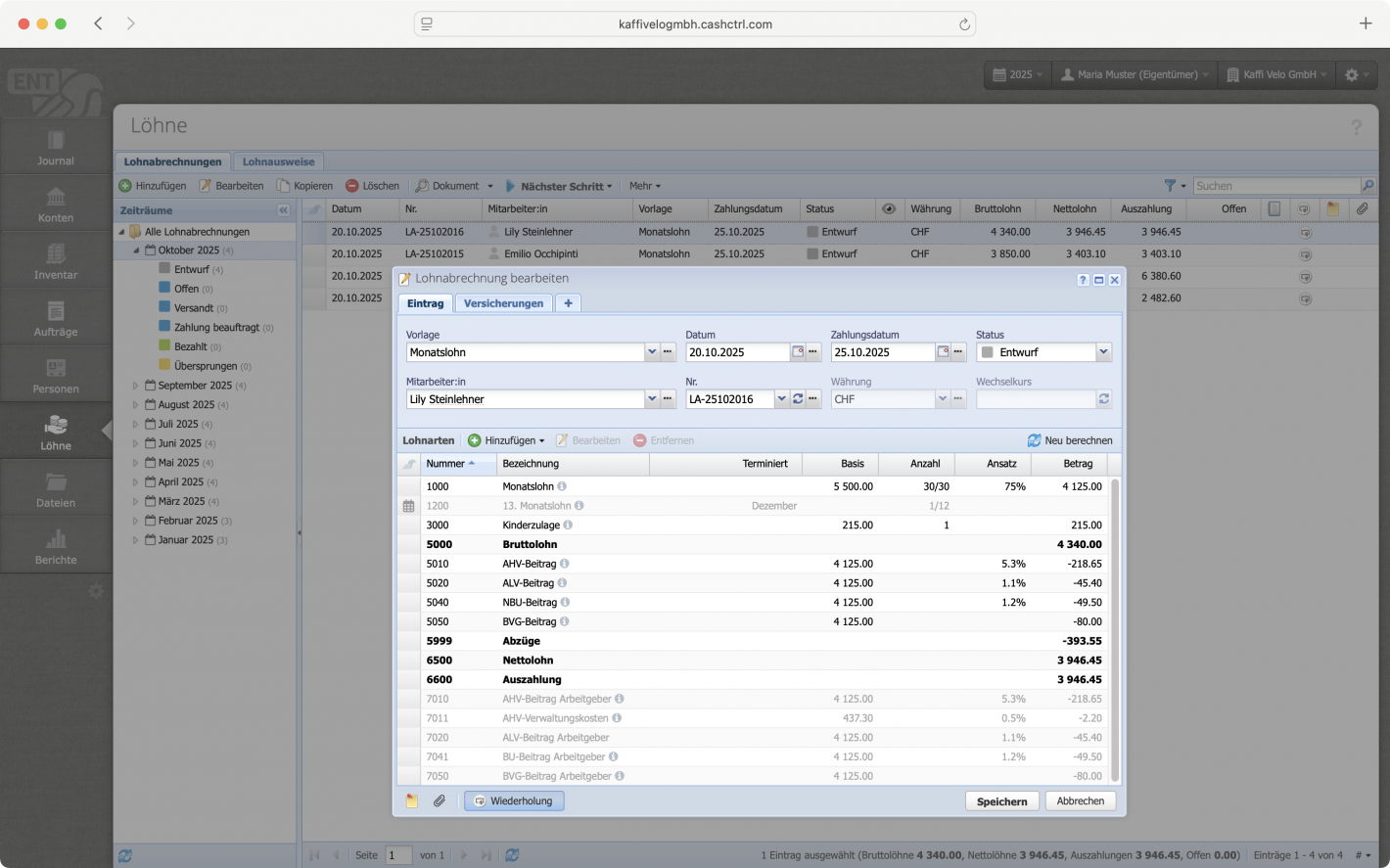

Select the payroll statement in the overview and open the dialog box by clicking Edit. Alternatively, select the most recent payroll statement under Persons/Payroll statements and edit it.

Payroll statements that have already been sent should not be modified. Ideally, a draft for the coming month should be edited.

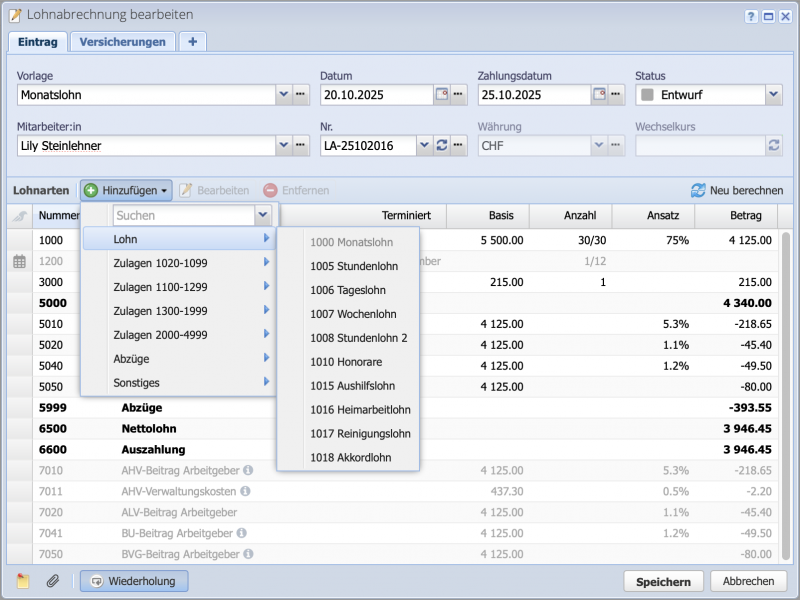

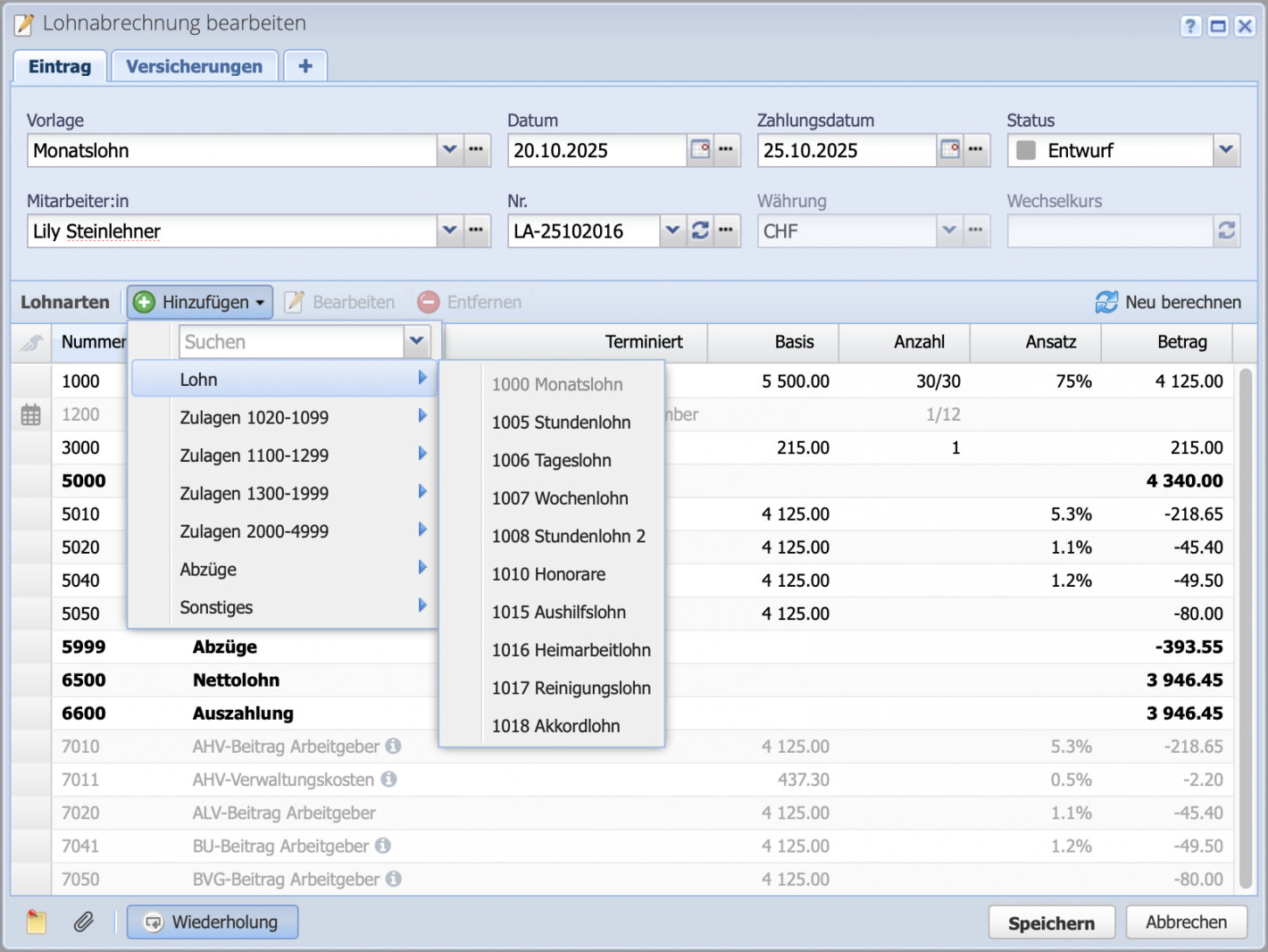

Add wage types in two ways using the Add drop-down menu. Use the search field to enter the wage type number or name. Alternatively, select from the categories of allowances and deductions.

Allowances/deductions are sorted directly by their numbering and automatically listed in the correct position in the table.

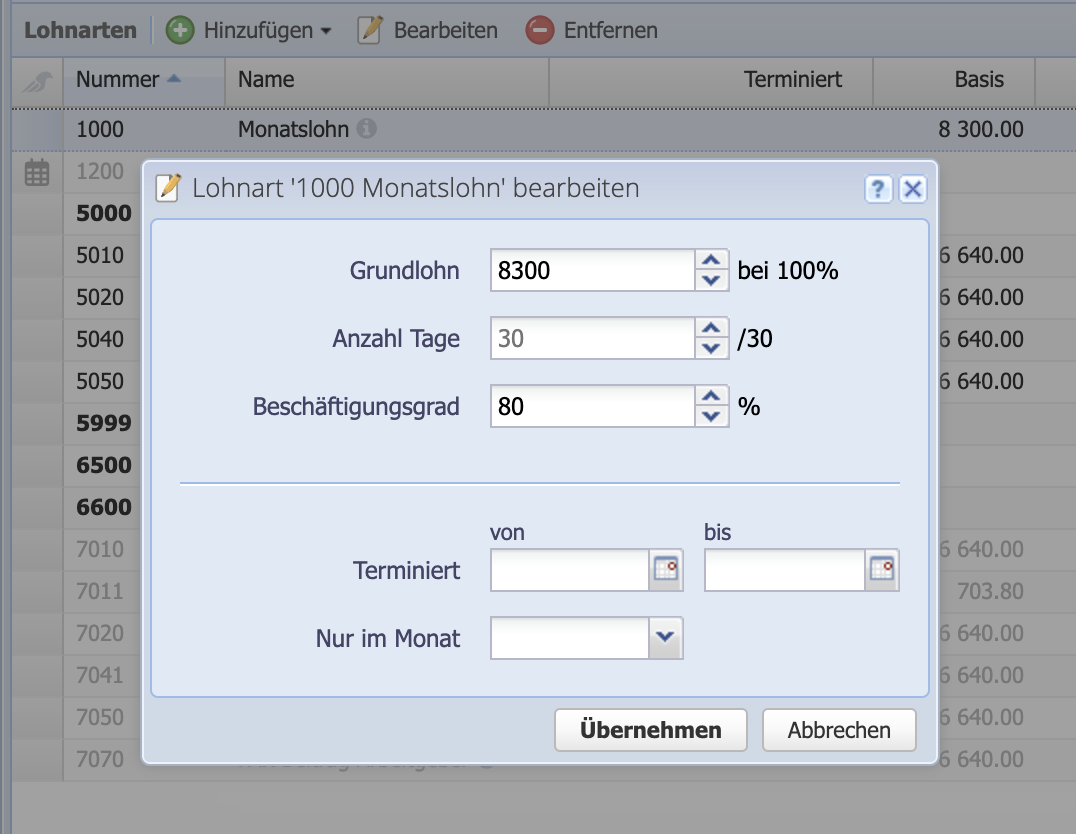

A change in working hours has a direct impact on the monthly wage. If a higher or lower number of working hours is entered, CashCtrl automatically calculates the wage amount.

Important: Quickly check whether all deductions correspond to the new salary. Allowances or deductions with fixed amounts are not automatically adjusted, but percentage-based salary types are.

Continue with Apply and Save.

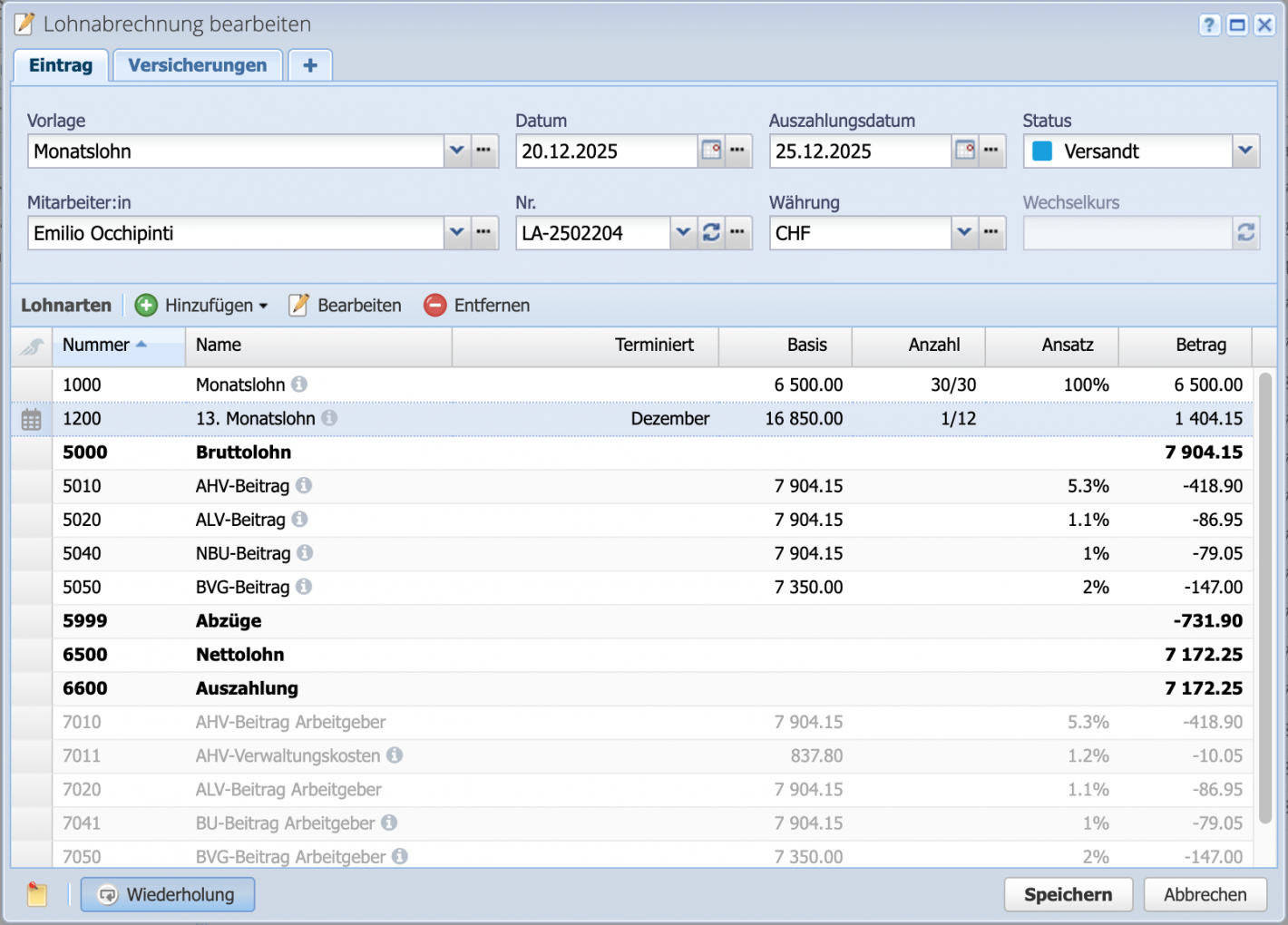

If a 13th month's salary is paid, it makes sense not to enter this manually, but to list it in the salary template (Salary configuration/Salary template). Then schedule it for the month of December. In December, the amount is automatically calculated (1/12 of the annual salary) and listed on the payslip.

Bonuses and other payments are listed as amounts and can also be scheduled.