Club accounting - What you need to know

Provisions concerning associations are laid down in the Swiss Civil Code. In contrast to corporations or limited liability companies, the purpose of an association's activity is not to generate a profit. Rather, like-minded people in such associations pursue a hobby without dedicating themselves to an economic task. Nevertheless, the exercise of the association's activities entails various financial obligations. Also associations can have incomes and expenditures, as well as have assets. Keeping accounts is therefore a good idea - an appropriate accounting software is a must.

Accounting obligations for associations and non-profit organizations

According to Art. 69a ZGB, associations are legally obliged to keep accounts, whereby this task is the responsibility of the executive committee. The regulations of the Swiss OR about commercial bookkeeping and accounting are to be applied analogously. Most associations are not obliged to register in the commercial register, which means that it is sufficient to keep accounts of income, expenditure and assets - simple bookkeeping is sufficient.

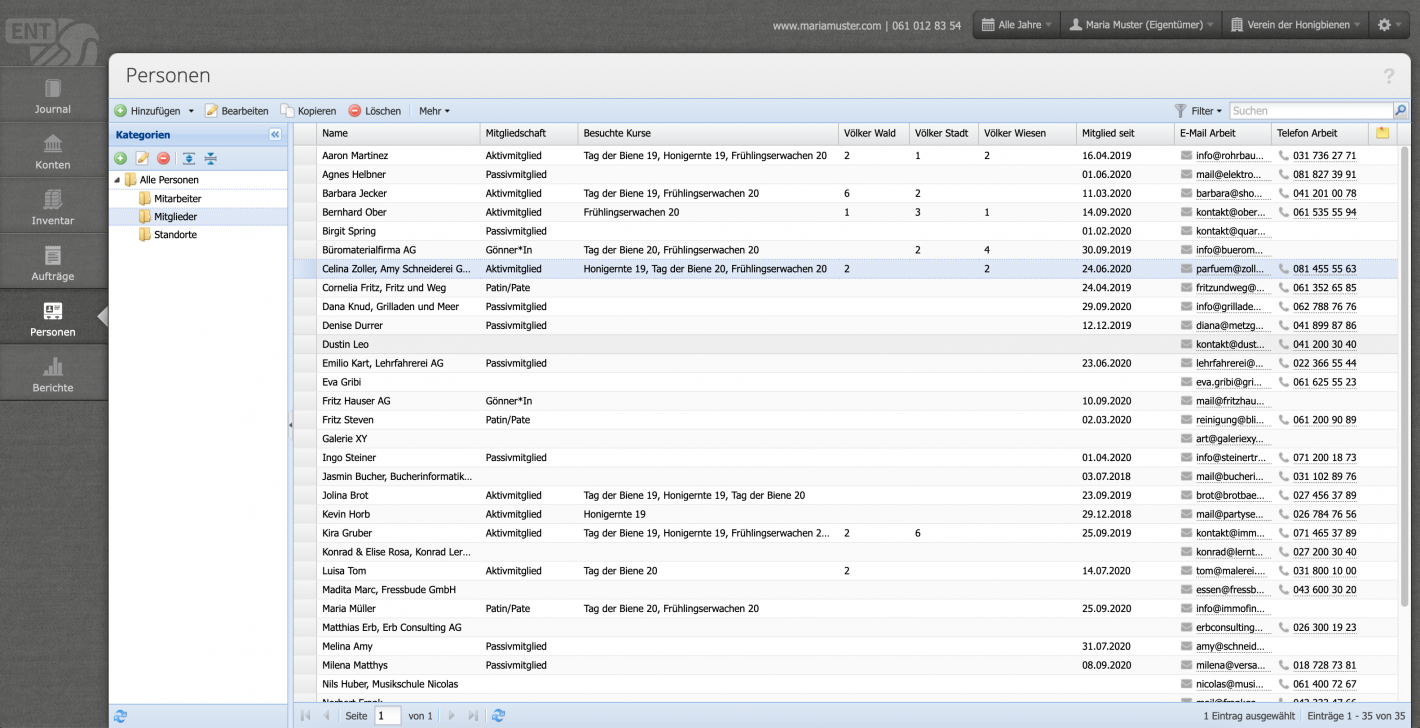

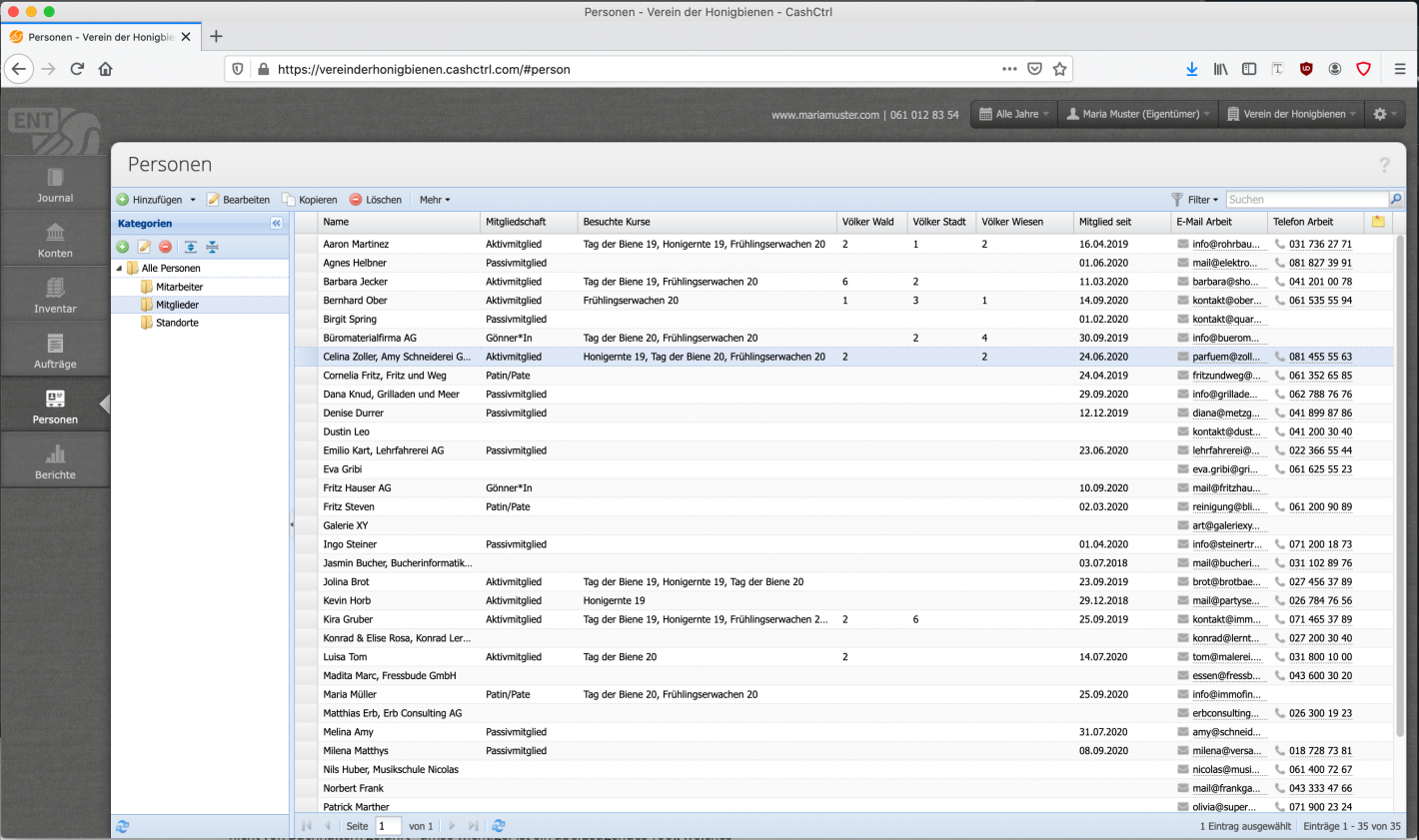

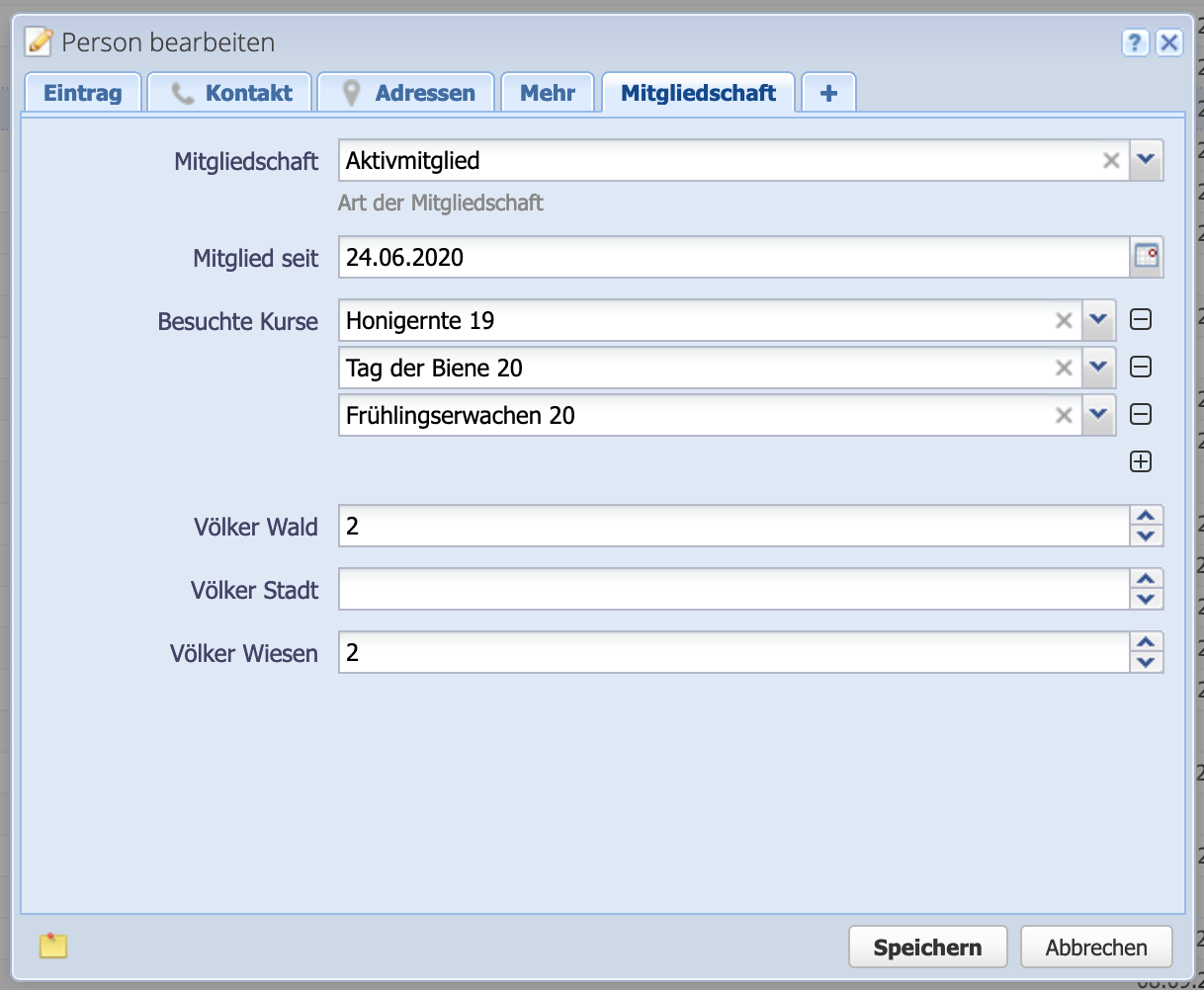

Conclusion: CashCtrl - The tool for the association bookkeeping

Keeping the association's accounts should not take up too much time - after all, the interests of an association are different. It is important to take advantage of the help of an accounting tool in order to have the accounting done as soon as possible. CashCtrl offers clubs a tool with convincing performance to handle the accounting correctly and in a more acceptable time. Whether income, expenses, financial situation or address management of your club, CashCtrl ensures that your books are correct. Simple, intuitive and secure.