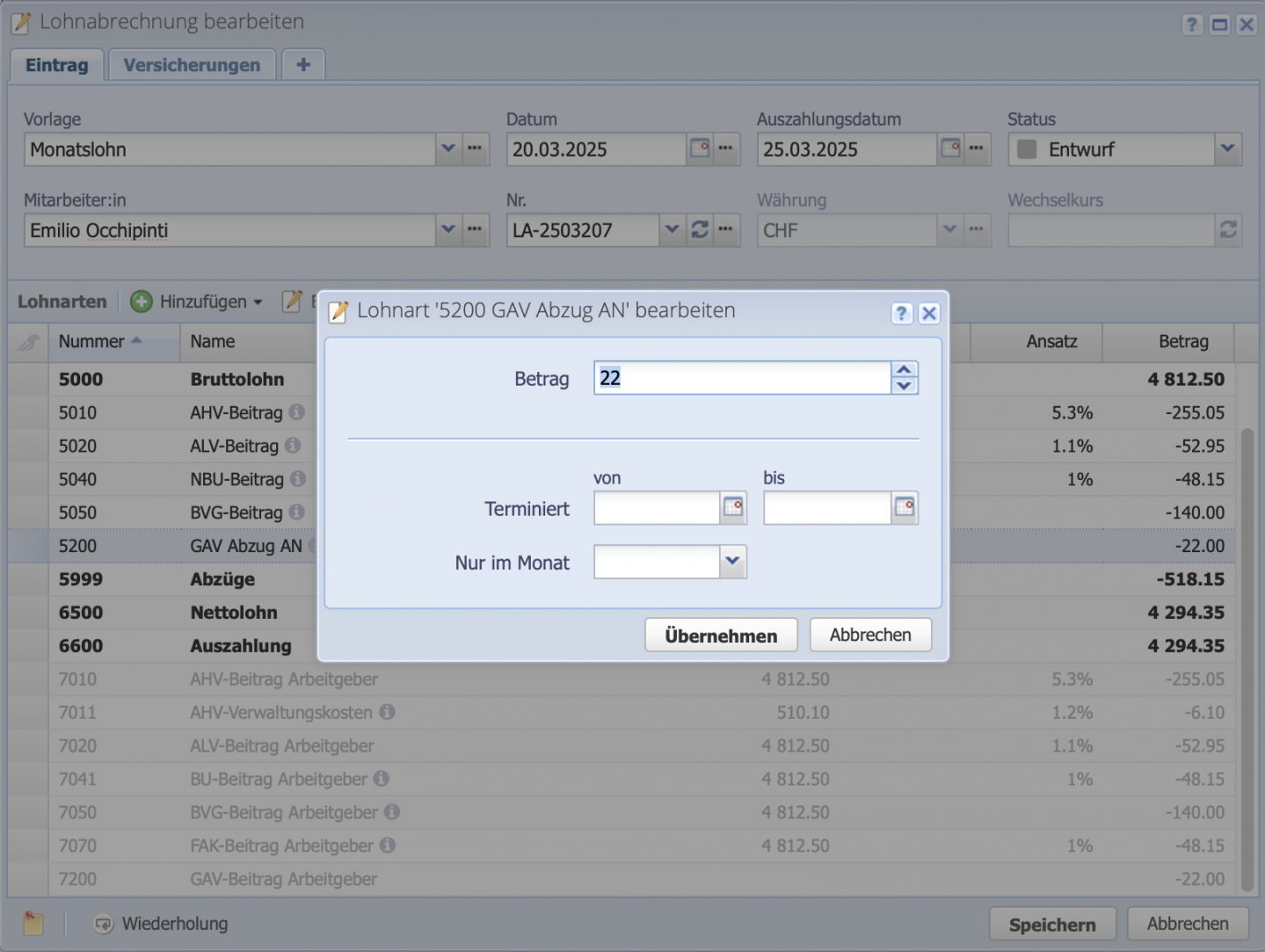

There are specific deductions depending on the industry. Using the example of an industry-specific fixed amount that is deducted 50/50 by the employee and employer, the tutorial shows how to create salary types.

Please enter a search term.

Error ~ No results could be loaded.

Create your custom salary type

Payroll accounting tutorial: Create an industry-specific deduction or a cantonal tax as a new salary type. We demonstrate an example.

Contents

- Open payroll configuration

- Create/copy new salary type

- Edit input field

- Define sums

- Save salary type

- Create additional salary type (optional for employer contribution)

- Use salary type — Done

Jump to Video Tutorial (German)

2. Create/copy new salary type

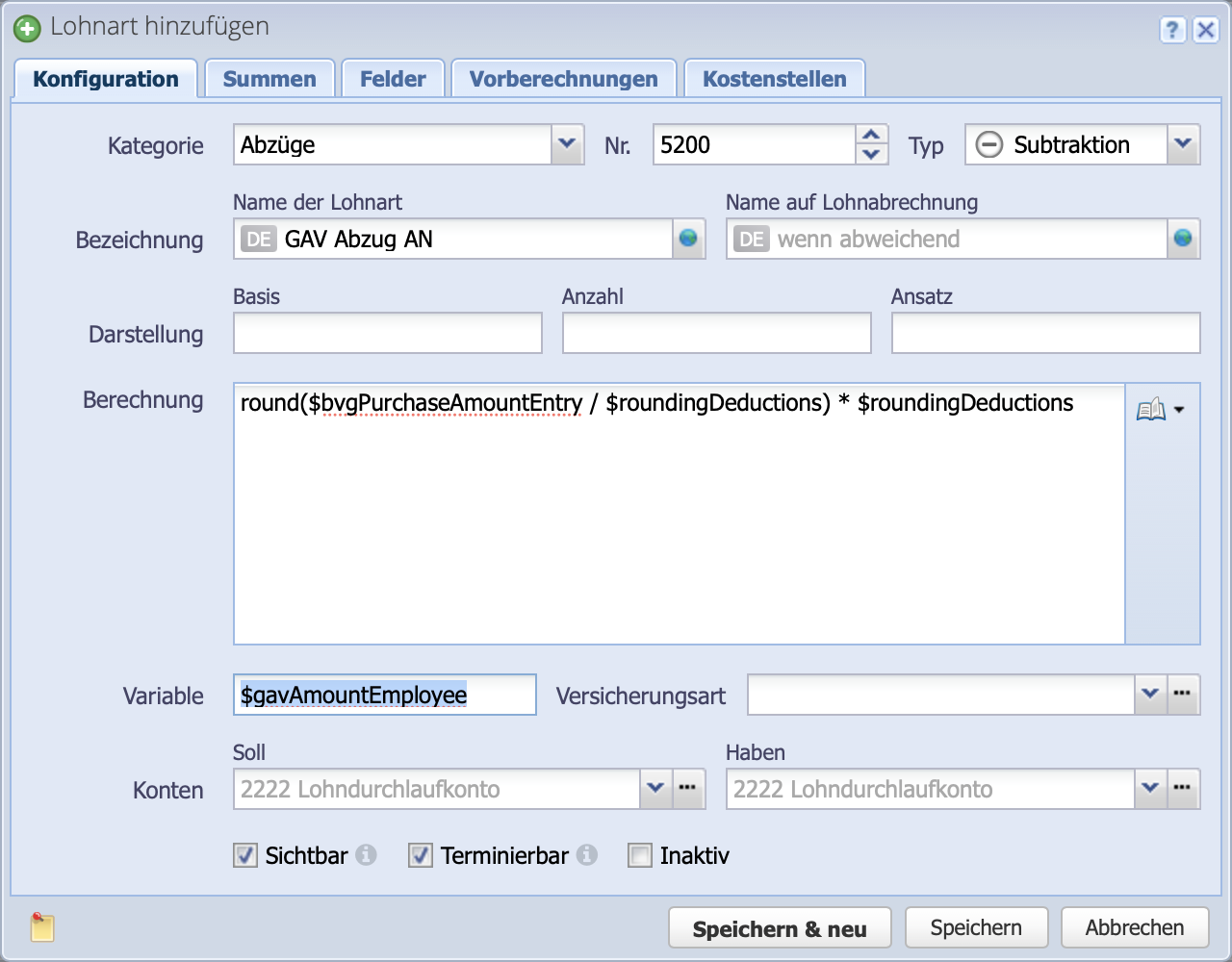

Clicking Add opens the dialog box for creating a new salary type.

It is a good idea to copy an existing deduction in order to transfer certain specifications. For example, salary type 5051 BVG purchase contributions can be copied for a fixed amount without precalculations.

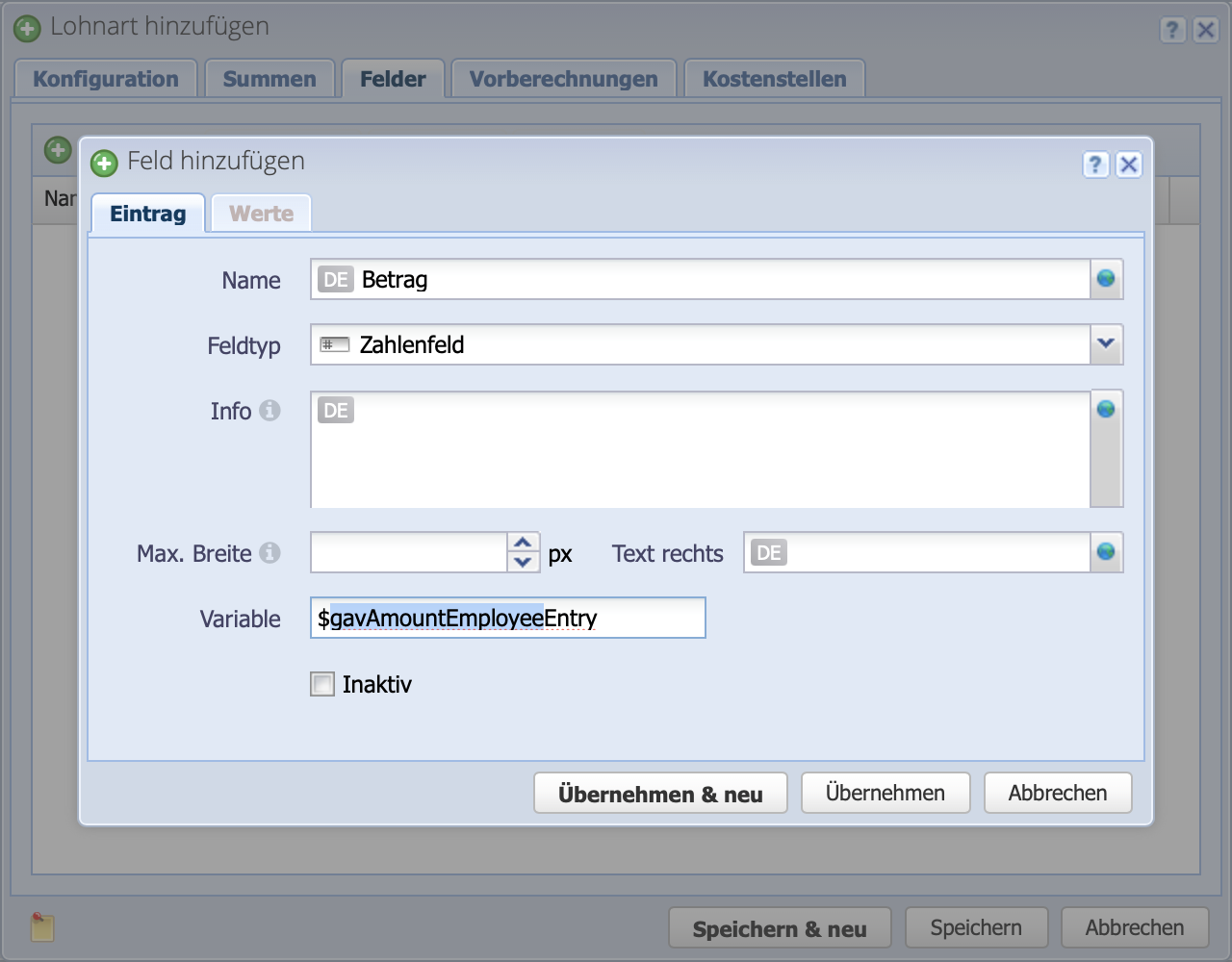

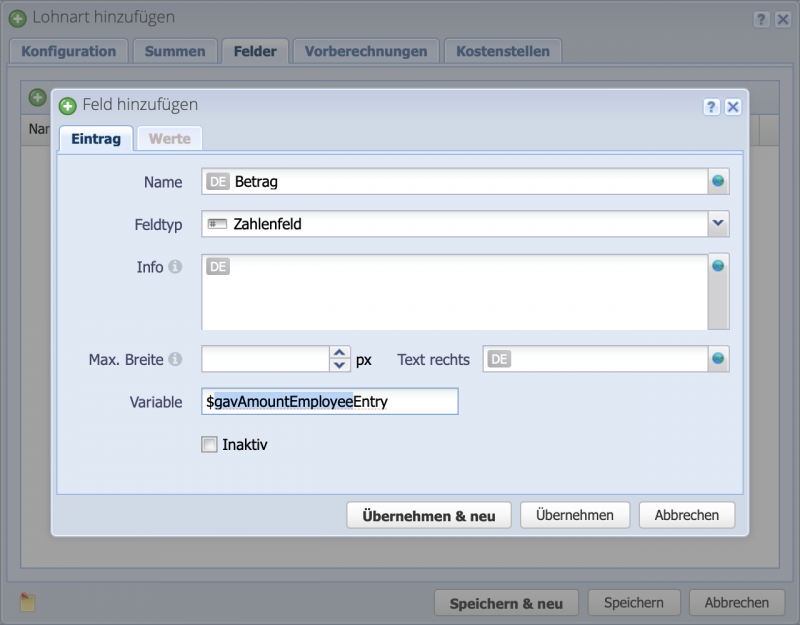

First, create the variable in which the calculated amount will be stored: $gavAmountEmployee

Continue in the Fields tab.

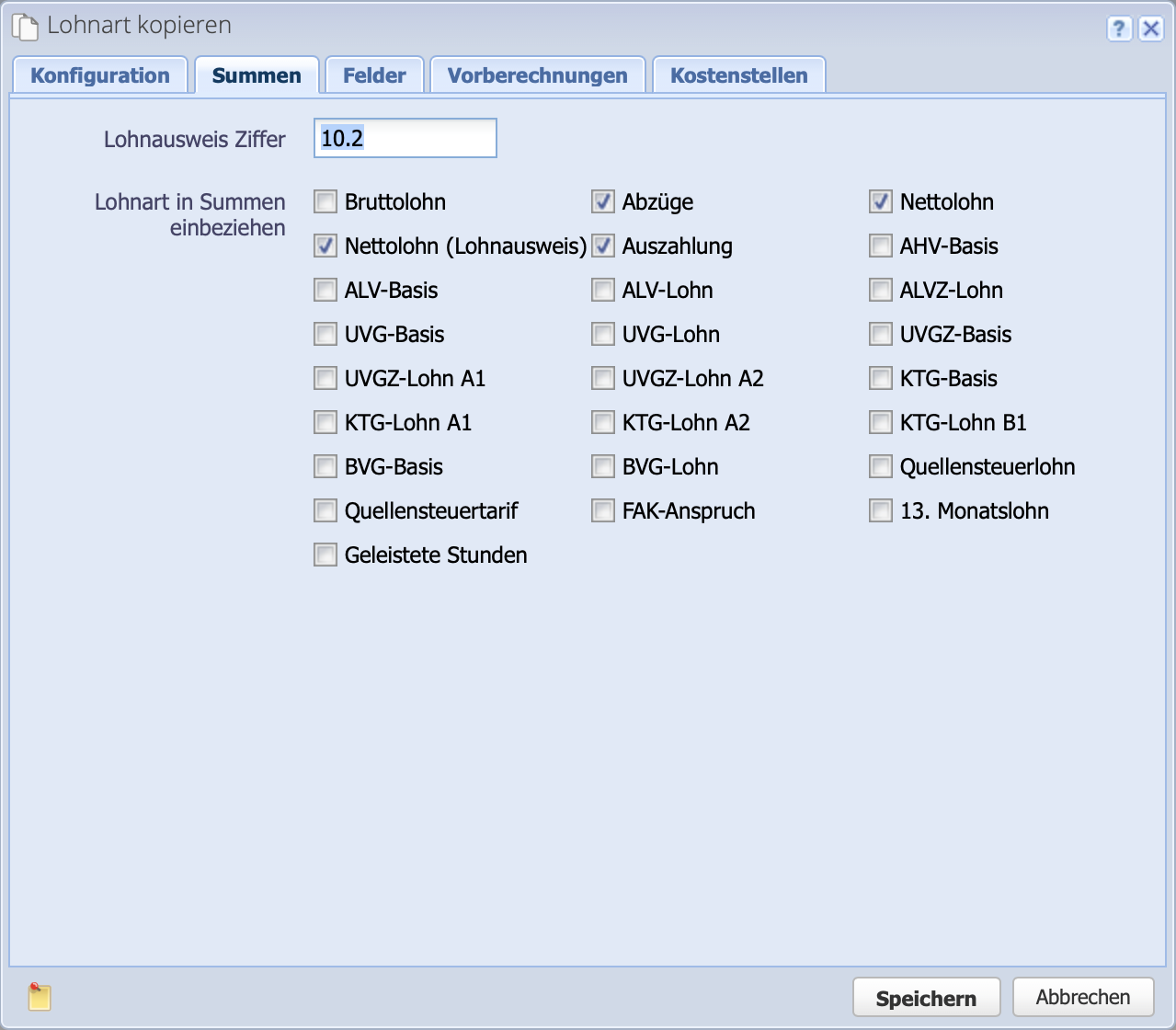

4. Define sums

Here, you can define which totals this wage type is included in by checking the boxes. In the example, this means that the deduction is included in the total deductions. The deduction is also taken into account in the net salary and in the payment sum.

If a deduction is to be shown on the salary certificate, you can specify the number on which the salary type is shown.

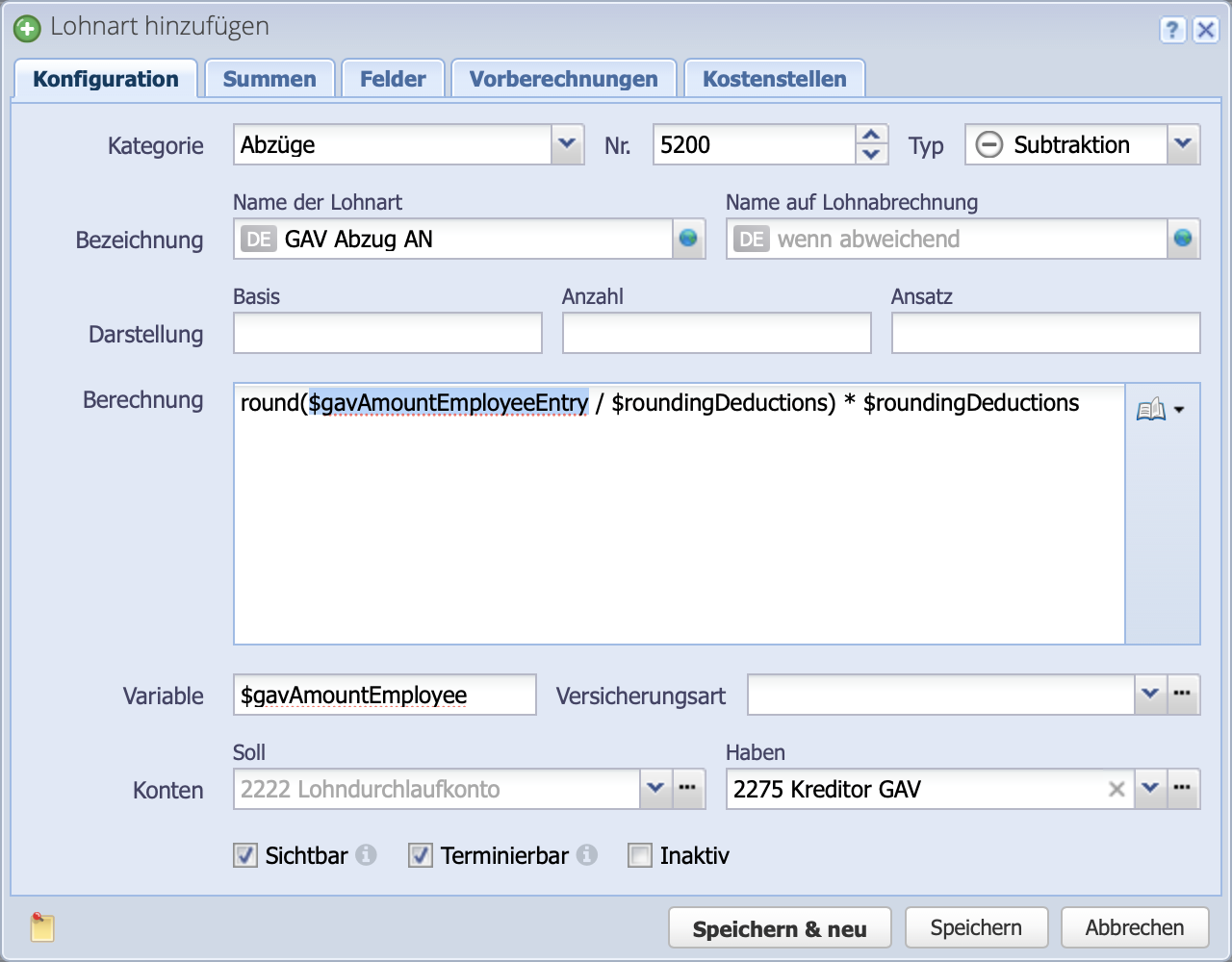

5. Complete configuration

Switch back to the Configuration tab. Here, the variable defined in the Fields tab is now inserted into the calculation field. Since salary type 5051 BVG purchase contributions was copied here, the variable $bvgPurchaseAmountEntry must be replaced with $gavAmountEmployeeEntry.

You can now set your own credit account in the Credit field for the salary type or assign an existing one.

Complete the process by clicking Save.

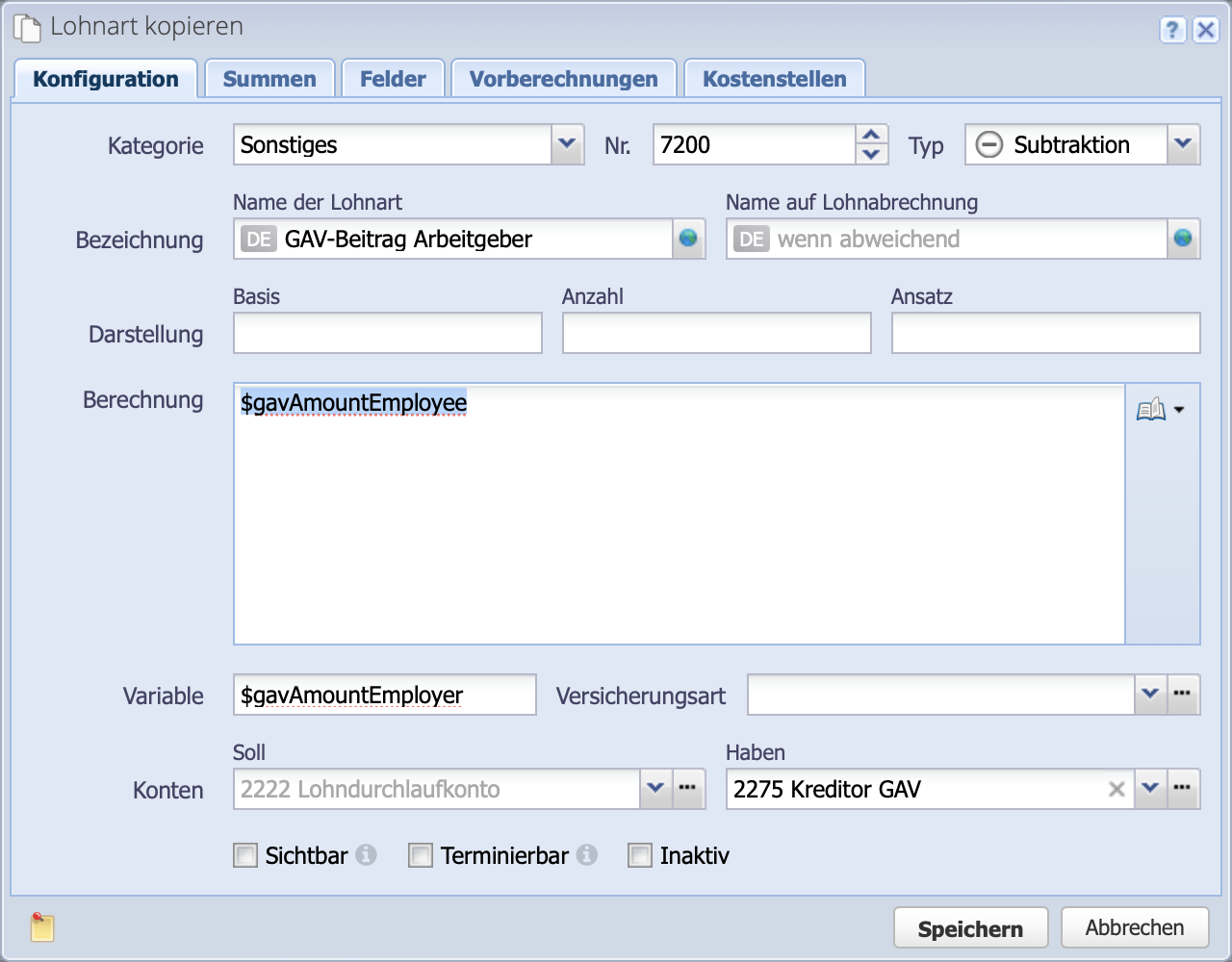

6. Add employer deduction (optional)

If an employer contribution is to be created as an additional salary type, salary type 7010 AHV contribution employer is recommended in the case of a equal deduction.

The settings in the Totals, Fields, and Preliminary Calculations tabs are left as they are.

The name and number are overwritten, e.g., with 7200. The variable of the GAV deduction employee is now inserted in the calculation field: $gavAmountEmployee. This means that the amount entered for wage type 5200 GAV deduction employee is also deducted for the employer.

$gavAmountEmployer is set as the new variable.