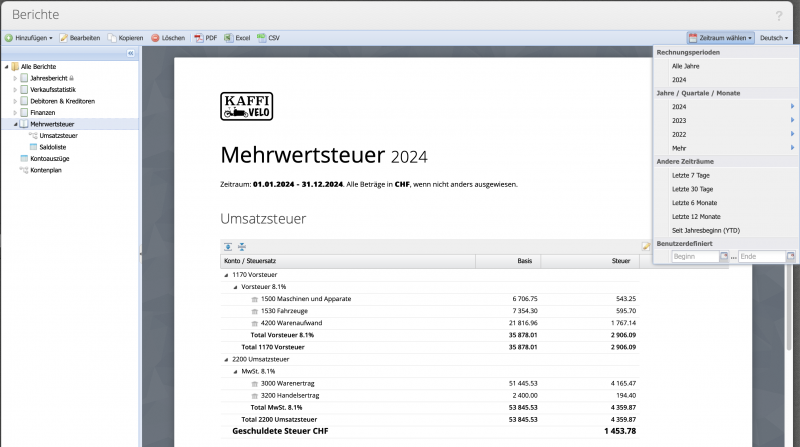

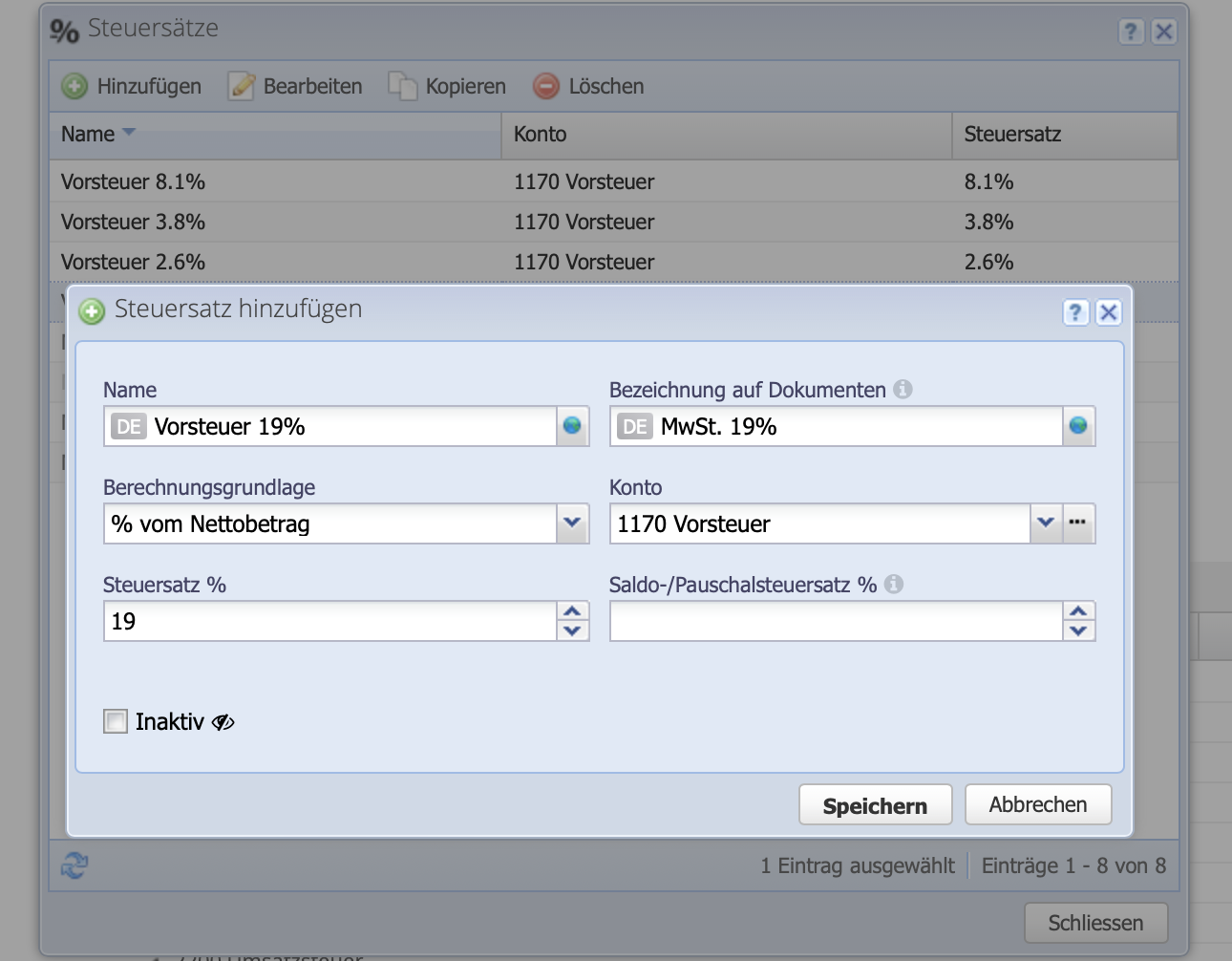

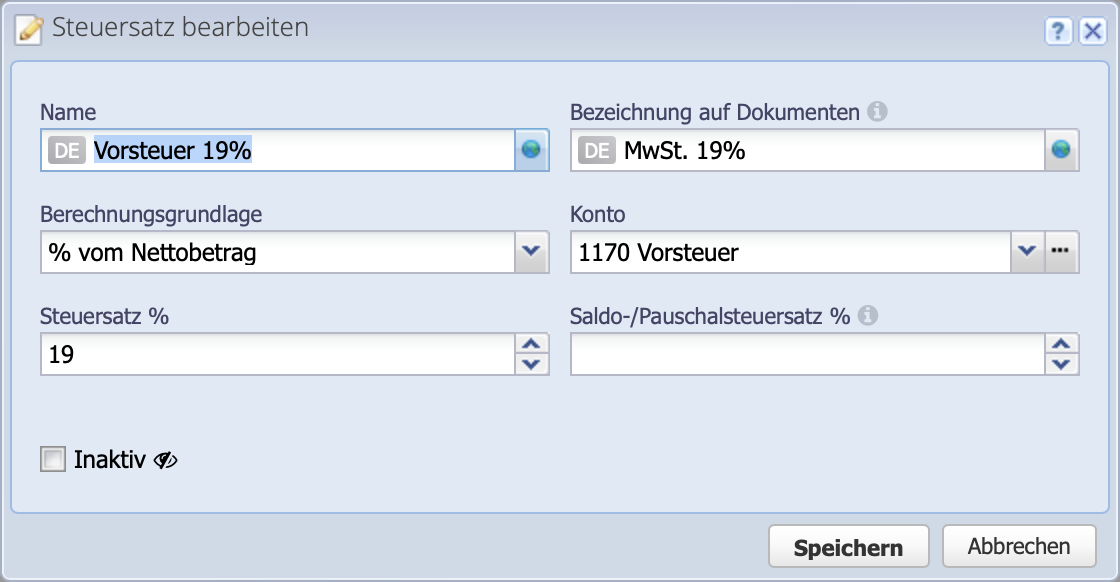

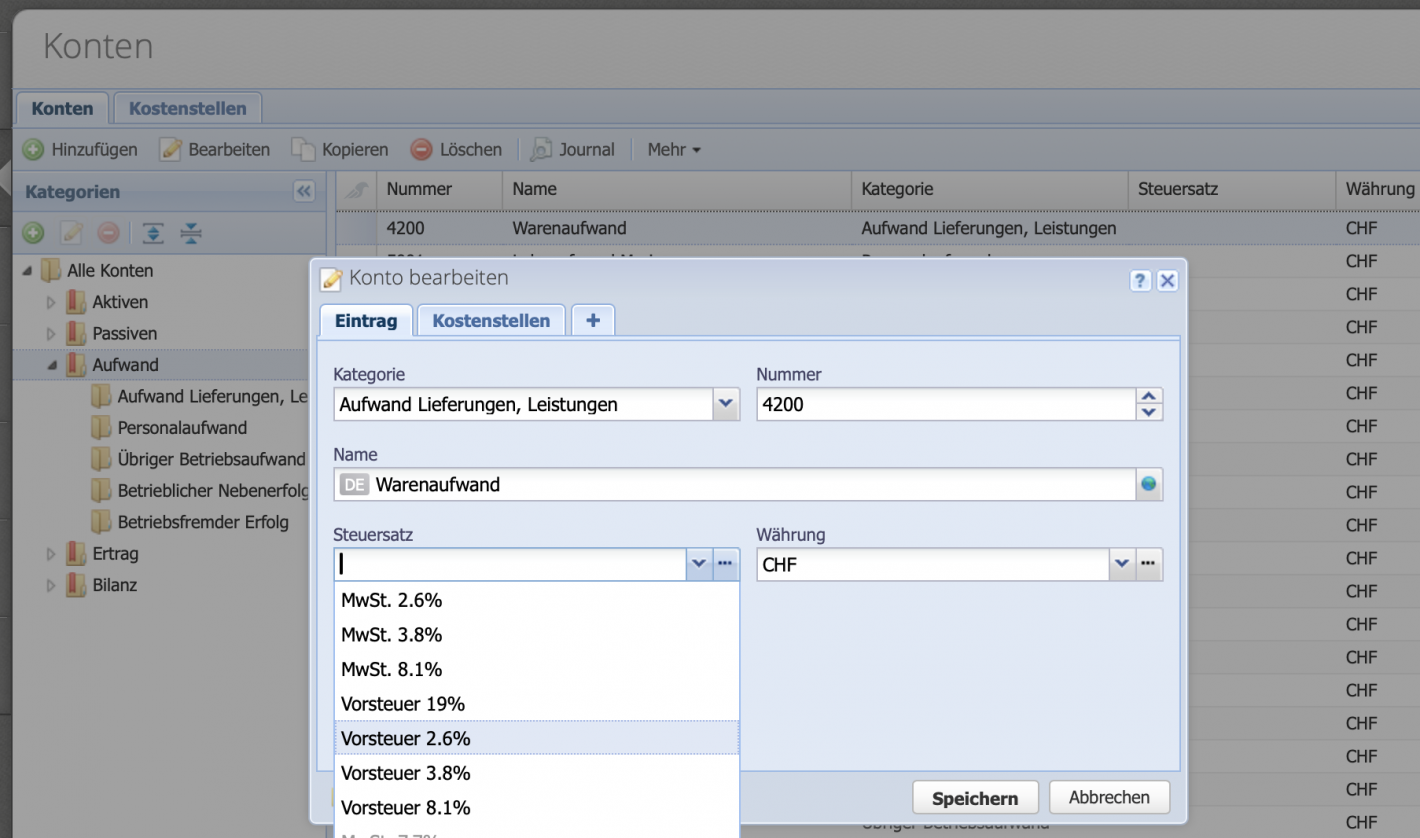

1. Enter input tax rates

Before entries are recorded, the tax rates must be set up. This is done under Settings Tax rates. Three input tax rates are already configured by default. Via Add you can create your own tax rates or via Edit or double-click existing tax rates can be adjusted.

Existing tax rates can only be modified or deleted if no entries have been made with them. Otherwise the rate can be deactivated, deactivated rates will no longer be suggested when posting.